Jan 24, 2018

Personal Investor: Survey finds investors really like their advisors

By Dale Jackson

2017 was a wake-up call for investment advisors. Mid-year was the deadline to provide clients more details about their accounts under the terms of regulatory reforms called CRM2. One of the more contentious disclosure requirements involved expressing all advisor fees in dollar amounts in addition to the usual percentage.

It was a big deal because, as the industry well knows, a percentage fee hidden in a larger mutual fund management fee is much less noticeable than a dollar figure on an account statement. A typical trailer fee on a mutual fund is one per cent. On $100,000 in mutual funds that’s an eye-popping $1,000.

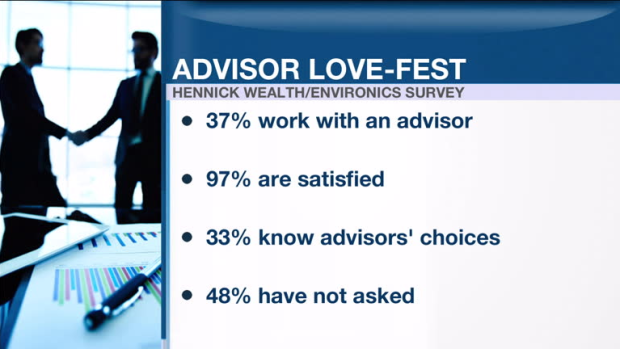

Advisory firms fought the new rule, fearing the disclosure would send clients running to the exits. But, a new survey by Environics for Hennick Wealth Management shows 97 per cent of Canadians with advisors are satisfied with them.

The survey doesn’t go into much detail, but there could be two reasons for the outcome. First, 97 per cent of investors with advisors could truly be satisfied. There are some very good investment advisors out there who may have prepared clients for the disclosure in advance by explaining the value of their services. Better advisors may have already expressed their fees in dollars.

Second, 2017 was a good year on the markets. Advisors often get credit for broader trends beyond their control. On the other hand, they also take undeserved blame when markets go down.