Sep 25, 2017

Personal Investor: Wise millennials choose TFSAs over RRSPs

By Dale Jackson

Millennials are growing up in more ways than one. As the leading edge of the Internet generation enters its 30s, the latest census from Statistics Canada finds 42 per cent of investors aged 25 to 34 prefer the tax-free savings account (TFSA) to the registered retirement savings plan (RRSP).

That means they are willing to forego the instant gratification of an RRSP tax refund – and it makes perfect sense. An RRSP refund is based on the contributor’s income. Most younger wage earners are in a lower tax bracket, which means the refund is lower. By taking a pass on an RRSP contribution they can carry their allowable contribution space forward to a year when they are in a higher tax bracket, and the tax savings are higher. They also have the option of using funds from a TFSA for an RRSP contribution in the future.

RRSP contributions and gains throughout the years are eventually taxed when withdrawn. TFSA gains, on the other hand, are never taxed – providing an advantage to lower income contributors that choose them.

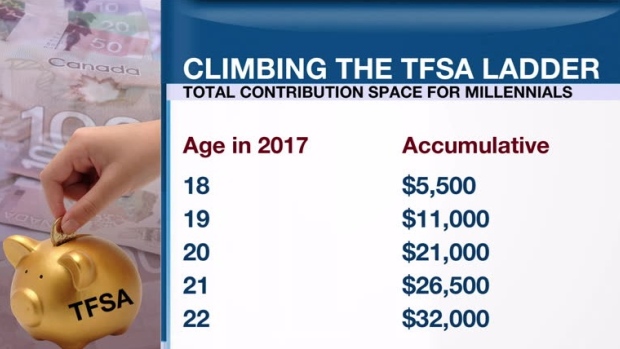

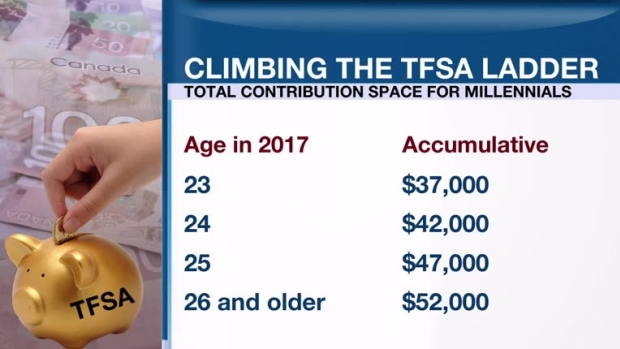

Determining TFSA contribution limits for millennials can be tricky. Canadians who were 18 or older when the TFSA was introduced in 2009 have a maximum contribution limit of $52,000. However, those who have turned 18 since 2009 have only accumulated contribution space for the years they were over 18.

The Canada Revenue Agency (CRA) tracks TFSA contribution space and provides it on individual tax return statements each year. TFSA space is also available on individual account profiles on the CRA website.

If you are under 26 years old in 2017 here is your total available contribution space: