Feb 21, 2023

Peru’s Economic Outlook Brightens as Mass Protests Wane

, Bloomberg News

(Bloomberg) -- The mass protests that have wreaked havoc on Peru’s mines, agriculture and tourism appear to be running out of steam, boosting the chances of an economic rebound with President Dina Boluarte still in power.

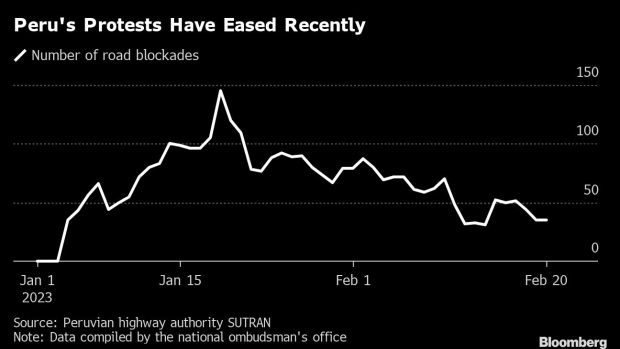

Measured by the number of highways blocked across the Andean nation, the demonstrators are rapidly dispersing, even though their main demands haven’t been met.

The number of roadblocks has fallen by three quarters from a peak in January, according to Peru’s highway authority. On Tuesday, blockades were overwhelmingly concentrated in just one remaining area, the southeastern region of Puno.

“It looks as though things are changing for the better,” said Eduardo Jimenez from economic consultancy Macroconsult. “February should have economic growth somewhat higher than what we saw in January, when we expect a figure close to zero.”

In a country that has had seven presidents since the start of 2016, many Peruvians didn’t expect Boluarte’s presidency to last long, but she has so far managed to cling on to power amid the worst unrest in decades. Protesters began blocking key highways almost as soon as she took office in early December, calling for her resignation and fresh elections, but are now showing signs of fatigue.

Peru’s most famous tourist site, Machu Picchu, reopened this month, as the intensity of unrest dropped.

The unrest has left 60 dead, mostly civilian protesters killed in clashes with the security forces. The disruption has also caused a spike in inflation as supplies of food and other goods were disrupted.

Despite the uptick in consumer price rises, Peru this month halted its steepest-ever series of interest rate rises as policymakers fret about the growth outlook. Some analysts forecast that the central bank will be the first in the region to start cutting interest rates, in a scenario in which the economy remains weak.

Read more: Ex-Finance Chief Sees Peru Interest Rate Cuts as Soon as April

Waning Unrest

Lawmakers went on recess this week, promising to look into the issue of elections at some point in the future. President Dina Boluarte has repeatedly insisted that she won’t resign.

“Authorities have not bet on solving the crisis, but rather on deflating it,” said Gonzalo Banda, a Peruvian political analyst.

By going on recess, congress has helped remove the issue of immediate elections from the center of public debate, he said. After eleven weeks of activity, protesters are also tired, he added.

The waning unrest is welcome news for Peru’s businesses and for the central bank, though some analysts fear it could easily flare up again since its underlying causes haven’t been fixed.

An Ipsos poll this month showed 76% of Peruvians want Boluarte to resign and 70% want for new elections to be called this year. Boluarte took over on Dec. 7 after President Pedro Castillo was impeached after he tried to dissolve congress.

“While this administration continues in power, protests are going to continue in cycles while hurting the economy,” said Omar Coronel, a Peruvian sociologist specializing in studying unrest.

Tough recoveries

Peru’s agriculture industry appears to have recovered the most, Jimenez from Macroconsult said, as key highways were reopened in the middle of the key grape harvest. Peru is a major exporter of fresh produce including grapes, blueberries, avocados and asaparagus.

Many of the nation’s largest copper mines remain disrupted, however, including MMG Ltd’s Las Bambas and Glencore’s Antapaccay. Minsur SA’s San Rafael tin mine, hasn’t operated since Jan. 12.

Read more: MMG Keeps One Peru Plant Running Even as Mining Remains Halted

Tourist arrivals have risen from January lows, but remain far from a full recovery.

“The first quarter has been catastrophic, I’m not exaggerating,” said Juan Stoessel, CEO at Casa Andina Hotels, Peru’s largest hotel chain.

Still, bookings are now rising while cancellations are falling, he added.

As the outlook brightens, Morgan Stanley this week recommended buying Peruvian stocks.

Peru is “more resilient than you think,” it said, in a report published Tuesday. “Solid macro fundamentals should help avoid the possibility of an economic derailment due to social unrest.”

©2023 Bloomberg L.P.