Feb 1, 2023

Peru’s Inflation Spike Offers a Glimpse of Damage From Unrest

, Bloomberg News

(Bloomberg) -- Peru’s inflation is forecast to have jumped to the highest level in a quarter century as official data start to reflect the damage wrought by two months of social unrest and highway blockades.

The January report, due to be published Wednesday at 10 a.m. local time by the national statistics agency, is attracting greater-than-usual interest as economists try to gauge the impact of the most destructive protests to hit the copper-producing nation in decades.

Before mass demonstrations began to bite in mid-December, inflation had shown signs of having peaked, and the central bank was predicting its return to the target range by the end of the year. Now, annual consumer prices rises are expected to have jumped to the highest level since 1997, after agricultural regions were cut off by civil unrest, potentially leading the bank to prolong its series of interest rate rises.

Annual inflation accelerated to 8.97% in January in Lima according to the median forecast of analysts surveyed by Bloomberg, with estimates ranging from 8.7% to 9.83%. That’s up from 8.46% in December.

The central bank is forecast to raise its policy rate for a 19th straight month next week, to 8%, extending its steepest-ever phase of monetary tightening. A new surge in inflation may lead the bank to continue hiking rates even longer, according to Dan Pan, an Americas analyst at Standard Chartered Bank.

“The protest activities during the past few weeks have caused tremendous damage to the economy,” Pan said, speaking by phone from New York.

Read more: Lima Records Death After Congress Refuses to Expedite Vote

The extra inflation from the protests is likely to cause policymakers to “reluctantly have to continue to extend the hiking cycle,” which will cut 2023 growth, she added.

The central bank monitors the Lima price index, but shortages have been more acute outside the capital. This means the national inflation rate is likely to be even higher, said Felipe Hernandez, a Latin America analyst at Bloomberg Economics.

Violent Turmoil

The demonstrations were triggered by the ouster of former President Pedro Castillo, who tried to dissolve congress before being impeached. Swathes of the country remain paralyzed by highway blockades, while more than 50 people have lost their lives in the violent turmoil sweeping the country.

The protests have left President Dina Boluarte under siege almost since the day she took over from Castillo. Her government has so far proved unable to restore peace or revive economic activity.

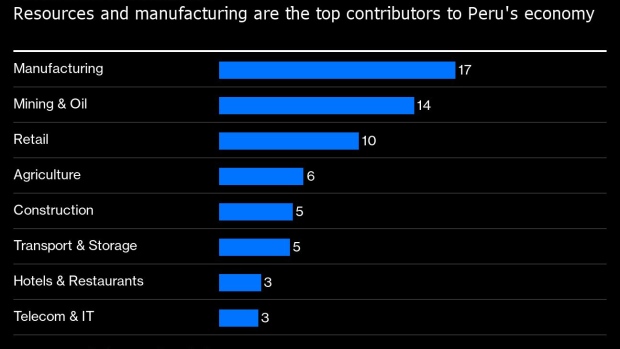

The demonstrators are calling for her to quit, and for new elections to be held. The southern regions hardest hit are home to many of Peru’s biggest mining and agribusiness operations, as well as being the heartland of its tourism sector.

Peruvian consultancy Macroconsult estimates that the economy expanded 0.5% in January from a year earlier, down from a forecast of 2% before the protests.

Read more: Peru Protests Put Huge China-Owned Copper Mine on Brink of Halt

Peruvian Finance Minister Alex Contreras told CNN in Spanish that the impact on gross domestic product would be “moderate.”

©2023 Bloomberg L.P.