May 31, 2023

Pet Retailer Chewy Soars as Recurring-Purchase Program Drives Sales

, Bloomberg News

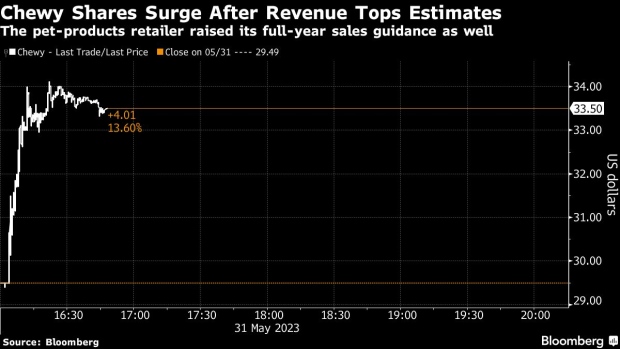

(Bloomberg) -- Chewy Inc. stock surged the most in almost four years after the pet-products retailer beat sales expectations. It got a boost from a recurring-purchase program.

Net sales per active customer and sales through Autoship, which offers prescription refills, discounts and scheduled deliveries of supplies, “both reached new record highs for the company and continues to fuel customer loyalty and spend toward our platform,” Chewy Chief Executive Officer Sumit Singh said in a statement. Net sales per active customer exceeded $500, up nearly 15% from last year.

Chewy also raised its full-year sales guidance.

The shares powered as much as 27% higher on Thursday, the biggest gain since 2019. The move pared the stock’s year-to-date decline to about 2%.

Chewy said in a shareholder letter that it looks forward to “steady growth in profitability” through new initiatives, including the company’s first international expansion, into Canada.

Chewy “noted they have not seen any trade down or slowing purchase activity during the past few months which is a contrast to the broader retail backdrop,” Citigroup analyst Steven Zaccone said in a research note.

That contrasts sharply with pet-retail rival Petco Health & Wellness Co., whose stock tumbled the most on record after results last week showed that spending on discretionary items like pet collars and leashes declined. Petco CEO Ron Coughlin said at the time that the “behavior is consistent with past times of economic uncertainty.”

©2023 Bloomberg L.P.