Mar 2, 2023

Petrobras CEO Stuck Between Dividend-Hungry Investors and Lula

, Bloomberg News

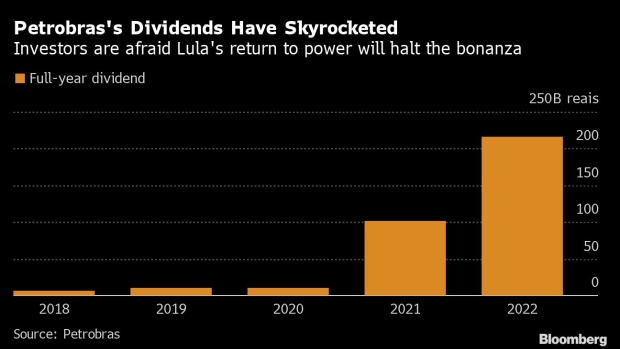

(Bloomberg) -- Petrobras’s new chief executive officer is navigating between Brazil’s ambitions for industrial development and investors who expect to be compensated with profits and dividends.

During his first earnings call with analysts and investors, Jean Paul Prates said Petroleo Brasileiro SA, as the company is formally known, will continue paying robust dividends, while also saying it needs enough money to invest in traditional oil operations and the energy transition. The company may return to petrochemicals and fertilizer production, he added.

While he was speaking, President Luiz Inacio Lula da Silva said half of Petrobras’s dividends should fund investments, underscoring how much pressure the company will be under to deliver jobs and growth to a faltering economy. The tension gets to the heart of Petrobras’s dual role as a publicly traded oil company that is also a national champion that many politicians and residents believe should provide affordable fuel and create jobs.

“Companies propose a trade-off situation to shareholders; leave money with me and I’ll show you very good projects,” Prates said. “The investor decides whether he wants to stay with us, or with the right cash from the short-term dividend.”

The future of how Petrobras pays dividends will certainly change. Prates said he had doubts about how strict the rules should be on dividend distribution, and the company has already started setting aside a portion of dividends into a separate fund.

A main concern for Petrobras investors is what will happen to gasoline and diesel prices. Politicians of all stripes in Brazil have pressured the oil giant to contain fuel inflation, raising fears among investors of Petrobras subsidizing it.

Prates promised stiffer competition with rival importers who gained market share in recent years. He added that strictly following import parity when setting prices isn’t always in Petrobras’s best interest.

“This is the best price for our competitors, not necessarily for us,” he said.

©2023 Bloomberg L.P.