Sep 23, 2021

Philippines Holds Key Rate to Spur Growth Amid Higher Prices

, Bloomberg News

(Bloomberg) -- Sign up for the New Economy Daily newsletter, follow us @economics and subscribe to our podcast.

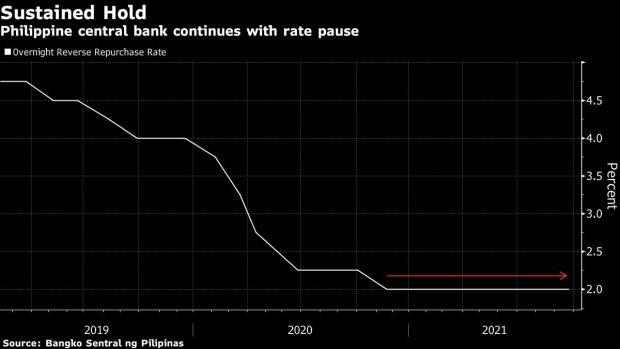

The Philippine central bank held its key interest rate steady for a seventh straight meeting as the economy gradually reopens from pandemic lockdowns, while signaling that consumer prices will rise faster than previously anticipated for the next few years.

Bangko Sentral ng Pilipinas left the benchmark rate at 2% Thursday, as predicted by 21 of 22 analysts in a Bloomberg survey. One predicted a 25 basis point reduction.

“The outlook for recovery continues to hinge on timely measures to prevent deeper negative effects on the Philippine economy,” central bank Governor Benjamin Diokno said in a briefing. “Together with appropriate fiscal and health interventions, keeping a steady hand on the BSP’s policy levers will allow the momentum of economic recovery to gain more traction by helping boost domestic demand and market confidence.”

The country’s financial markets closed before the decision. One-month peso non-deliverable forwards barely moved on the news.

Economic managers see the country’s output returning to its pre-pandemic level only by the end of next year or early 2023. The Philippines is among Southeast Asian nations slowly easing restrictions on movement, shifting away from harsh lockdowns that have destroyed jobs and slowed any recovery.

What Bloomberg Economics Says...

“Bangko Sentral ng Pilipinas’ decision to keep its policy rate steady despite a renewed pickup in inflation underscores that the central bank’s focus is on supporting the economy’s weak recovery. Assuming the expected slowdown in inflation materializes in the months ahead, we see BSP maintaining that support through most of 2022.”

Justin Jimenez, Asia economist

Click here to read the full note

The central bank expects credit activity to recover in the coming months on more targeted restrictions and sustained easy policy.

The BSP raised its inflation forecasts Thursday, saying risks to the outlook are tilted to the upside this year and broadly balanced in 2022 and 2023. The new CPI forecasts are:

- 4.4% this year, compared to a previous estimate of 4.1%

- 3.3% in 2022, versus 3.1% previously

- 3.2% in 2023, up from 3.1%

(Updates with chart, governor quote in third paragraph, Bloomberg Economics quote box, CPI forecasts at bottom.)

©2021 Bloomberg L.P.