Apr 20, 2022

Philippines Must Grow Over 6% to Cut Debt, Finance Chief Says

, Bloomberg News

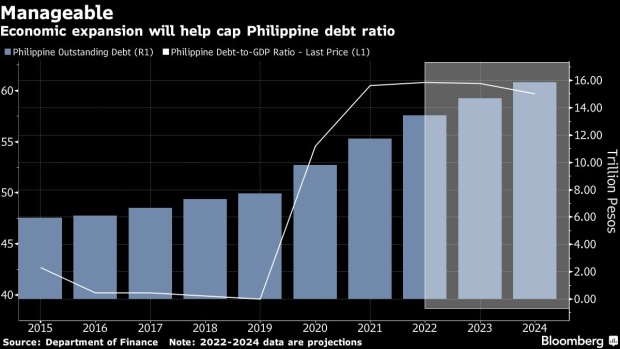

(Bloomberg) -- The Philippines must grow by more than 6% annually in at least the next five years to get out of the debt bloated by the Covid-19 crisis, Finance Secretary Carlos Dominguez said.

“The biggest challenge for the next administration is really to grow out of the debt we incurred during the pandemic,” Dominguez said in an interview Thursday with Bloomberg Television’s Kathleen Hays. “The next administration would have to design policies and stick to very strict fiscal discipline to grow out of these debt problems,” he said.

The pandemic disrupted consumption and business activity, which in turn crimped tax revenue and pushed the Southeast Asian nation to rely more on debt to fund spending plans. While Dominguez recently said he’s readying a fiscal consolidation plan for the new government, analysts at Barclays Plc to Fitch Solutions see the presidential election in May leading to policy continuity.

The Philippines targets a growth rate of 7%-9% this year as consumption starts returning to pre-pandemic levels. The government extended the least stringent movement curbs through end-April in metropolitan Manila, which accounts for a third of the nation’s economic output.

Highlights:

- The Philippines is watching the U.S. and other countries raising interest rates to ensure it’s not behind as it balances growth, inflation and preserving capital, the finance chief said

- The peso’s depreciation is within “manageable limits,” he said

- The government is studying what more can be done to collect the estate tax owed by the family of late dictator Ferdinand Marcos whose son, Bongbong, is running for president, Dominguez said

©2022 Bloomberg L.P.