Oct 27, 2022

Philippines to Tap Its ‘Not-So-Secret Weapons’ to Cushion Peso

, Bloomberg News

(Bloomberg) -- Inflows from millions of Filipinos working overseas and hundreds of call center companies in the Philippines may help anchor the peso above the 60 per dollar level until the end of the year, according to traders and analysts.

Filipinos abroad typically send more money home for the Christmas holidays while the business-process outsourcing industry has become a steady source of dollar receipts, giving the nation some leg up amid a record $6 billion trade deficit.

“Filipinos overseas and the thriving call center industry have been our not-so-secret weapons,” said Joy Gallega, president of ACI Philippines, the association of currency, fixed-income and derivatives traders. “They can help offset the weakness in exports.”

The peso may trade within the 58-59 per dollar range for the rest of the year as remittances pour in, Gallega said. The currency climbed for a third day on Thursday to 58.25 per dollar, its strongest level in a month.

Overseas remittances are expected to total $35 billion by end-2022 while outsourcing revenues should add another $30 billion this year, according to Michael Ricafort, chief economist at Rizal Commercial Banking Corp.

The two sectors can bring $15.8 billion in inflows between now and year-end, and the nation can use $10 billion of that to defend the peso, Finance Secretary Benjamin Diokno said Oct. 21.

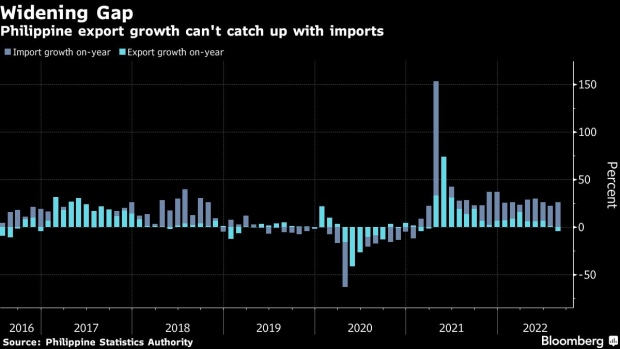

Resurgent demand for imported goods as the economy reopened, coupled with shrinking exports, particularly of electronics, highlight the importance of other dollar sources to support a currency that has lost nearly 13% this year against the backdrop of the US’s aggressive monetary tightening. The nation’s intervention this year was estimated by Exante Data Inc., which specializes in tracking capital outflows, at $8 billion.

Receipts from remittances and outsourcing can plug the estimated $60-billion trade gap for 2022 and along with foreign tourism revenue and other inflows “fundamentally provide some cushion for the peso,” Ricafort said.

Hedging

The peso had also been under pressure lately as large buyers of dollars look to cover their next two to three months worth of invoices for purchases such as oil, traders said, adding that these are legitimate hedging practices.

A fourth consecutive outsized increase in the key rate should help anchor the currency, said ACI’s Gallega, also Philippine Business Bank’s fixed income head, predicting at least a half-point hike in the central bank’s November policy meeting. Policy makers will couple this with other tools like market intervention and mopping up of excess liquidity, he said.

Another “solid move” by the central bank on the policy rate will be crucial, according to Security Bank Corp. chief economist Robert Dan Roces. He estimates the country’s ballooning imports bill -- forecast at $142 billion this year -- could blow past the $136 billion seen from export earnings, remittances and outsourcing revenues.

Central bank Governor Felipe Medalla this week said he will vote for a 75-basis-points rate hike if the Federal Reserve raises by that much at its next meeting. The Philippines has so far tightened by 2.25 percentage points this year, its most aggressive cycle in two decades.

“Dollar sources, plus monetary authority actions, may help with preventing the peso going past 60,” Roces said.

©2022 Bloomberg L.P.