Mar 30, 2023

Pickleball Bar Loan Portends US Small-Business Credit Crunch

, Bloomberg News

(Bloomberg) -- Act fast on that loan, a banker warned the couple planning to open a pickleball bar in Florida. In Maryland, a toy retailer is struggling with delays in renewing his credit line. An Indiana car-loan financier is nervously watching for any signs of trouble in repayments.

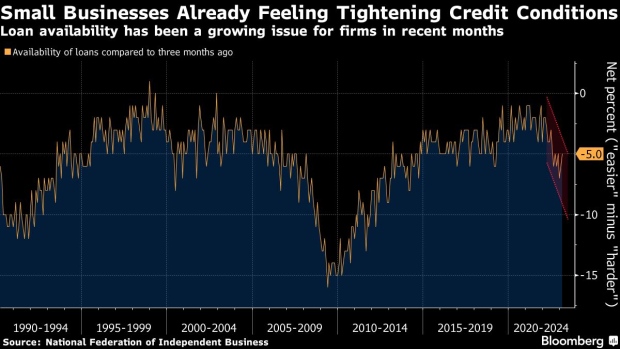

In the early fallout from banking sector turmoil, American small businesses are facing a tougher time accessing capital, compounding already-tight lending standards and soaring interest rates. That’s a bad omen for the US economy, and bankers are warning that things will only get worse.

The evidence is pointing toward the credit crunch economists warned about as the collapse of Silicon Valley Bank sent tremors throughout the financial system. Even before the banking crisis, household and business lending was already slowing and corporate and individual bankruptcies were ticking up.

“The Fed hiking rates, lingering issues around inflation, some challenges around securing workers and wage pressure and the fading away of a lot of stimulus — now add SVB on top of that,” said Matthew Mish, head of credit strategy at UBS Group AG. “It looks like the net result is that small and medium businesses are seeing a pretty material increase in stress.”

Read More: Lending Conditions in US Were Tightening Even Before SVB Failure

In Nocatee, Florida, a fast-growing suburb of Jacksonville, Matt Garvey and his wife are eager to open a new bar and grill with courts for pickleball, a paddle sport akin to tennis. They were deep into due diligence and arranging financing when their banker gave them a word of warning following SVB’s failure earlier this month.

“‘Matthew, it’s not impossible, but if you’re going do it, do it quickly because we anticipate a small business credit crunch,’” Garvey recalls the banker saying.

Since then, the couple has been moving as fast as possible to get the $2.5 million loan.

It was solid advice. In the days following the SVB fallout, Greg Schneider was speaking with clients at several regional banks who began to invoke “risk-based pricing” — essentially offering higher rates for riskier clients, a concept that rarely came up a year ago.

“Banks will be more selective about who they lend to,” said Schneider, who’s director of commercial loan analytics at Coalition Greenwich, a provider of financial data and analysis. “There was already pessimism about the overall environment.”

Credit Uncertainty

Consumers are the engine of the economy, and so far it’s too early to see an impact from the regional banking stress. Consumer confidence unexpectedly improved in March, according to the Conference Board’s index, which captured about of a week of data after SVB failed.

But other surveys point to cracks on the horizon. Sentiment has in large part been propped up by a strong labor market, and a recent measure by Penta and CivicScience shows a slump in confidence in finding a new job.

“As the excess savings dry up and as the labor market begins to soften later this year, we suspect the lack of credit will become even more evident in spending,” Wells Fargo & Co. economists Tim Quinlan and Shannon Seery said in a note that showed consumers are relying on credit much more than in the past.

Customers are still spending at Mike Brey’s toy retailer Hobby Works in Maryland, but the company’s founder is growing restless about financing the business going forward.

Brey has been trying to get his $250,000 working capital line at his regional bank renewed for more than a month now — a much longer delay than previous years.

He’s not sure whether the delay is related to issues at the lender — his banker won’t say. He has the same credit rating, assets and financials as last year. The only big difference is SVB.

“As I go through these crises, this is how they always start,” he said. “They say ‘it’s fine. It’s contained. It’s just this one industry.’ Then things just go off the rails.”

Car Lending

Jackson Hewitt Tax Service offers advance loans on tax refunds to people in need of quick cash. This year, the firm noticed an uptick in demand with clients saying they “needed access to their tax refunds sooner during a challenging economy,” according to senior vice president of marketing Kim Hudson.

Cracks have been perhaps most acute in car lending. About one in 11 Americans who applied for a car loan in February were rejected, the highest in six years, according to a Federal Reserve Bank of New York survey.

Dealerships are getting squeezed from all directions, said Marty McFarland, chief executive of Kinetic Advantage, an Indiana firm that helps used-car dealers finance their inventories. High prices have scared off many consumers and some lenders have left the market recently.

For now, so-called “floorplanning” firms that make inventory loans to dealers aren’t directly hurt by the SVB fallout, McFarland said. But he is watching his outstanding loans even more carefully lately, given the strain in the industry.

Another sign of the financial stress is the rise in bankruptcy filings by small businesses and consumers this year.

Filings by the smallest firms — those with less than $7.5 million in debt — were up more than 28% to 355 through March 28 compared to the same period in 2022, according to data provided by Epiq. More than 92,000 people have filed personal bankruptcies so far this year, up 18% from a year ago, the data show.

“The growing number of households and businesses filing for bankruptcy reflects the mounting economic challenges they now face,” said Amy Quackenboss, executive director at the American Bankruptcy Institute.

--With assistance from Reade Pickert and Steven Church.

(Adds chart)

©2023 Bloomberg L.P.