Jan 22, 2021

Pimco, BlueBay Bet on EM Local-Currency Debt as Dollar Slides

, Bloomberg News

(Bloomberg) -- Local-currency debt from the developing world may have room to run, even after a gauge that tracks it posted its best quarter in more than at least a decade.

Firms from Pacific Investment Management Co. to BlueBay Asset Management and Gramercy Funds Management are seeking local opportunities as emerging-market currencies strengthen amid a weaker dollar and an increase in capital flows. MSCI Inc.’s benchmark currency gauge is lingering just below an all-time high.

“Valuations in local-currency debt look more appealing,” BlueBay’s London-based head of emerging-market debt, Polina Kurdyavko, said in a webinar this week. She expects the asset class to outperform its hard-currency counterpart as developed world rates stay low while capital flows increase to emerging markets equipped with positive current-account dynamics.

Gramercy also pointed to the local bonds last week, flagging opportunity in the assets that lagged a recovery and stand to benefit as investors search for returns.

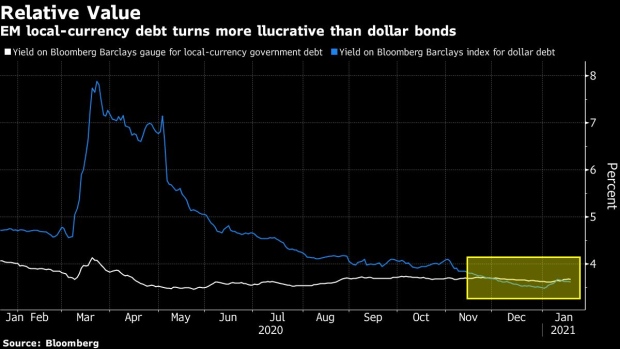

The local debt underperformed in 2020 as dollar debt posted the biggest yield reduction in eight years. The latter’s rally was so strong that the average yield on a Bloomberg Barclays gauge of dollar bonds has fallen below the rate on a similar index for local debt.

Now, however, prospects for a weaker dollar are negating that asset class’s edge, pushing local bets to the top of the list.

Also helping are expectations that more U.S. stimulus under President Joe Biden and accommodative policies from major central banks, which should support a global recovery in growth. Higher export prices would also bode well for emerging-market nations.

“Loose developed market monetary policy, rising commodity prices and effective Covid-19 vaccines are converging to drive global capital flows to emerging markets,” Pimco global strategist Gene Frieda and head of emerging-market portfolio management Pramol Dhawan wrote in a note this week. “These dynamics are likely to overshadow challenging domestic fundamentals and reboot growth in most economies, supporting local currency assets.”

Opportunities are emerging around the world. Buenos Aires-based financial broker TPCG Valores this week recommended an overweight position in Uruguayan local bonds, pointing to opportunities in inflation-linked securities as inflation stays above break-even rates.

Turnover in local-currency debt instruments stood at $672 billion in the third quarter, accounting for 59% of total reported emerging-market debt trading volume, according to an EMTA survey. Local Mexican securities were the most commonly traded for that quarter, followed by notes from Brazil, India, China and South Africa.

©2021 Bloomberg L.P.