Jul 1, 2022

Plunging Rupee Pushes India to Raise Taxes on Gold, Oil

, Bloomberg News

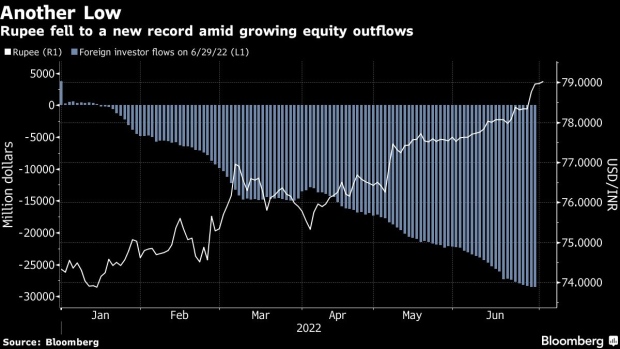

(Bloomberg) -- India tightened exports of oil and imports of gold in an all-out effort to rein in the rupee that plunged to a fresh record Friday.

The currency fell 0.2% to 79.1113 per dollar on Friday, after hitting multiple lows in recent weeks, while the benchmark index dropped 1%. The administration on Friday raised import taxes on gold, while increasing levies on export of gasoline and diesel.

Global investors have pulled an unprecedented $28 billion from the nation’s equities this year, and that along with higher oil import costs and a widening current account deficit have roiled the currency. A weaker rupee threatens to add to elevated inflation and may prompt the central bank to raise rates.

Read: India Raises Gold Import Tax Amid Trade Deficit, Rupee Low

A shortfall in India’s current account -- the broadest measure of trade -- will probably widen to 2.9% of gross domestic product in the fiscal year ending March 31, according to a Bloomberg survey in late June, nearly double the level seen in the previous year.

The government on Friday raised the import duty on gold to 12.5% from 7.5%, according to a notice dated June 30, reversing a cut last year. The higher taxes on the export of gasoline and diesel sent shares of Reliance Industries Ltd. down by as much as 4.3%.

Reserve Bank of India Governor Shaktikanta Das has said the central bank uses a multi-pronged intervention approach to minimize actual outflows of dollars and won’t allow a runaway rupee depreciation. The RBI has close to $600 billion of foreign-exchange reserves, which it has been deploying to curb any sharp volatility in the currency.

(Updates with government measures in the second paragraph)

©2022 Bloomberg L.P.