May 20, 2022

Poilievre's 'reckless' attack on Macklem blasted by Bay Street

, BNN Bloomberg

Pierre Poilievre says he'd fire Bank of Canada governor

Some prominent Bay Streeters are condemning recent criticisms hurled at Bank of Canada Governor Tiff Macklem by Conservative Party of Canada leadership candidate Pierre Poilievre, warning such threats could have long-lasting harmful impacts to the country’s economy and damage its reputation with international investors.

In recent weeks, Macklem has been a target of Poilievre’s, with the political figure saying if he were elected as Canada’s next prime minister, he would fire and replace Macklem for his handling of the central bank’s monetary policy amid runaway inflation. While it’s unclear specifically how the Governor could be replaced ahead of the end of his term, the comments are drawing the ire of finance professionals.

The harshest threats came during a May 11 Conservative leadership debate in Edmonton.

“I will fire the governor of the central bank to get inflation under control,” Poilievre said.

“To have a politician interfere like this in the realm of central banking is reckless and irresponsible and runs the risk of putting the sanctity of independence in jeopardy,” said David Rosenberg, president, chief economist and strategist at Rosenberg Research, in an email. He added that Poilievre’s public criticisms are “truly pure politics.”

“This is what political leaders do in basket-case dictatorships — think Turkey,” he said.

John O’Connell, chief executive officer of Toronto-based investment firm Davis Rea, said it appears Poilievre’s comments are aimed at appealing to a niche group of constituents.

“It’s easy to say stuff when only a small angry mob is listening (and any serious Conservative is just demoralized) and you are trying to win the seat at a table of mostly fringe candidates,” he said via email.

“I don’t see any solutions, just anger and popular vitriol.”

A recent Angus Reid poll conducted in March found 25 per cent of respondents selected Poilievre as the most appealing candidate to lead the Conservative Party – the highest number out of the four candidates confirmed at that time. Although these poll results were collected before Poilievre’s attacks on Macklem.

In an emailed statement to BNN Bloomberg, Pierre Poilievre said he’s not surprised “Bay Street Gatekeepers” are happy with Macklem’s performance.

“Central bank money printing is a bonanza for big business and big government. More dollars bid up prices, inflating the assets of the super rich and the cost of living for everyone else,” he said.

“The Bank Governor had one job: keep inflation at two per cent. Instead, he gave up his independence to become Justin Trudeau’s personal ATM machine.”

Aside from Bay Street, the criticisms have also appeared to strike a nerve within the Conservative Party. Interim Party Leader Candice Bergen announced Wednesday that Ed Fast would be stepping down as Conservative finance critic, partly because of Poilievre’s threats, which Fast said strains the party’s credibility on economic issues.

Poilievre’s vitriol directed at Macklem come as inflation hovers at a three-decade high. The latest Statistics Canada data showed consumer prices soared 6.8 per cent in April on an annualized basis and concerns are mounting over how long it will take the Bank of Canada to bring inflation back down in its target range of one to three per cent.

In a Financial Post opinion piece on Friday, Philip Cross, a senior fellow at the Macdonald-Laurier Institute and former chief economic analyst at Statistics Canada, said the Bank of Canada massively misjudged the economy, resulting in the runaway inflation households are dealing now.

While economists agree that inflation is generally linked to Bank of Canada monetary policies and government deficits, Cross said in a BNN Bloomberg interview on Friday that central banks should’ve been hyper vigilant to any uptick in inflation.

“Instead, when inflation first turned up in 2021, they just dismissed it as transitory. Then they said it was due to supply shocks and it would go away. Only now is the panic really setting in that they’re really behind the ball on this and they need to catch up rapidly,” he said in the interview.

Cross said by mid-2020, it was becoming clear that most of Canada’s economy was going to adjust to COVID-related lockdowns and that the initial emergency measures deployed should’ve transitioned to target lower-income Canadians and businesses hit hardest by the pandemic.

“But instead, we carried on with this economy-wide stimulus, both monetary and fiscal, for which we now see in retrospect, clearly demand has run well ahead of supply and that’s just a classic recipe for inflation,” he said.

He noted that other major central banks around the world have made a similar mistake.

With the pressure on Governor Tiff Macklem to get inflation under control, the bank is widely expected to deploy another half-point hike at the June 1 meeting, which would bring the key lending rate to 1.50 per cent. That comes amid expectations from some economists that high inflation will continue in the near term.

Most economists agree that some of the major drivers of inflation are widespread supply chain problems, renewed lockdowns in regions like China, and Russia’s invasion of Ukraine — all of which are supply-side issues that are much less responsive to monetary policy than overheated demand.

Rosenberg said putting the blame for inflation at the Bank of Canada’s feet is “completely off base” since the problem is global in nature.

“The bottom line, and the situation is identical south of the border, is that this type of supply-side inflation can only be resolved by the central bank by orchestrating a recession. And that's because central bankers do not have the skills needed to drill for oil, build semiconductor plants, or grow wheat,” he added.

CENTRAL BANK INDEPENDENCE

The threat of political intervention in Canada’s central bank has prompted concerns about the implications for central bank independence as well as questions about what firing Macklem would accomplish.

“I would like to see politics and central banks stay apart because I think that you need that clear lens and that steady hand because politicians are elected on a four-year cycle. And, you know, we can't sacrifice the long-term prosperity of the country for the next election bid,” said Ryan Bushell, president and portfolio manager of Newhaven Asset Management, in a May 13 broadcast interview.

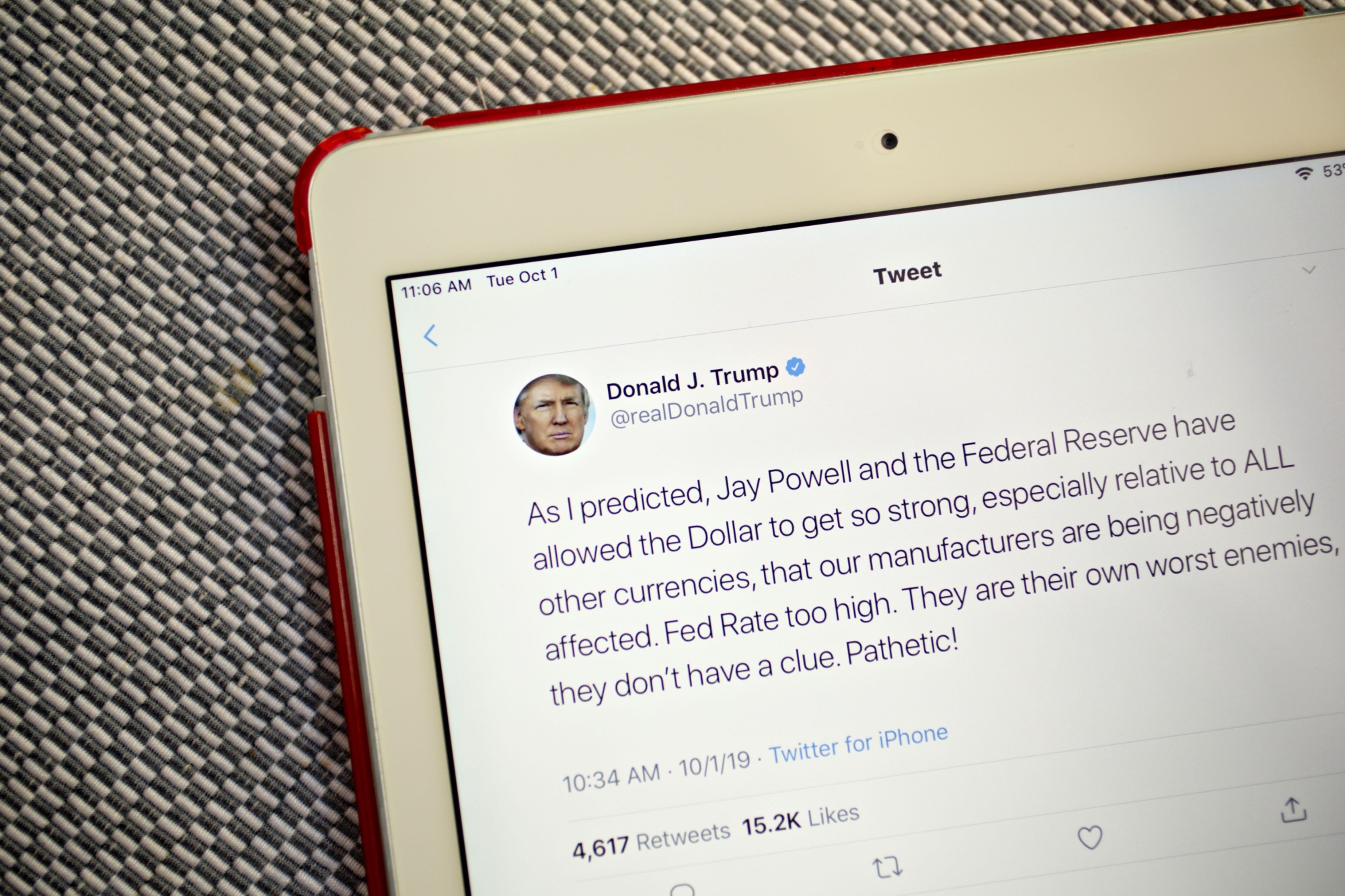

He said Poilievre’s public upbraiding of Macklem brings back memories of U.S. President Donald Trump’s attacks on the U.S. Federal Reserve and its Chair Jerome Powell and how it “sort of became commonplace.”

“I'm sad to see the Conservative leadership in Canada taking that same tact,” Bushell added.

It’s also worth noting the Bank of Canada has an agreement with the federal government on the bank’s independence: the feds set the central bank’s economic goal but it’s up to the bank’s staff to determine how to achieve it, as pointed out by former Bank of Canada Governor David Dodge in an email to BNN Bloomberg on May 12.

As for whether or not a politician would have the power to remove the central bank governor, the Bank of Canada Act is somewhat ambiguous.

The Act states the governor is appointed for a seven-year term “during good behaviour,” leaving what exactly constitutes as good behaviour up for interpretation.

Meanwhile, Rosenberg said the economic implications of firing Canada’s head banker could go further than we think.

“For a country that is so dependant on foreign capital inflows, firing any central bank governor, especially someone like Tiff Macklem, who is an expert on monetary policy — this 'open season' is unwelcome and troublesome and will not be regarded favourably by the global investor base,” he said. “Next thing you know, this unnecessary political intervention will result in a loss of confidence and the fallout will be on the Canadian dollar.”

“It’s not as if Canada is alone in an inflationary bubble. What exactly would it solve by firing the governor? It would certainly create international turmoil,” O’Connell added. “If [Poilievre] were the prime minister and he said this stuff — much less did it — we would all be paying the price.”