Sep 30, 2022

Poland’s Franc-Loan Legacy Topples Ailing Getin Noble Bank

, Bloomberg News

(Bloomberg) -- The legacy of Swiss-franc mortgage lending finally triggered the downfall of one of Poland’s lenders, with the ailing Getin Noble Bank SA forced to enter the country’s biggest-ever financial-sector restructuring.

The eight largest Polish banks and the state guarantee fund BFG will take over selected assets of the Warsaw-listed lender through a special vehicle and provide 10.3 billion zloty ($2.1 billion) toward the rescue, BFG said in a statement on Friday. The bank, which is controlled by financier Leszek Czarnecki, met its end after the foreign-currency loan business soured and management missteps failed to repair the damage.

The collapse of Getin underlines the lasting impact of the boom in Swiss franc mortgage lending in Poland, which predates the Great Financial Crisis and resulted in many households suing banks after their monthly payments ballooned in the wake of the zloty’s multi-year depreciation. Getin’s troubles extended beyond the mortgage loan woes that have troubled many peers, and the lender had lost money every year for the past six years.

Read More: Polish Banks Await Judgment on $31 Billion Franc-Loan Saga

The concerted move to seize the country’s 10th largest bank will spread the cost of the operation across the industry and avoid compelling individual lenders, especially the state-controlled PKO Bank Polski SA, into doing it alone, according to Lukasz Janczak, an analyst at Erste Group Bank.

Commerzbank’s unit mBank warned on Tuesday it expects to post a net loss for 2022 after increasing provisions for legal costs related to Swiss franc mortgages. The gauge of Warsaw-listed banks is down 47% this year, more than the WIG20 benchmark index, which has been the world’s worst performer.

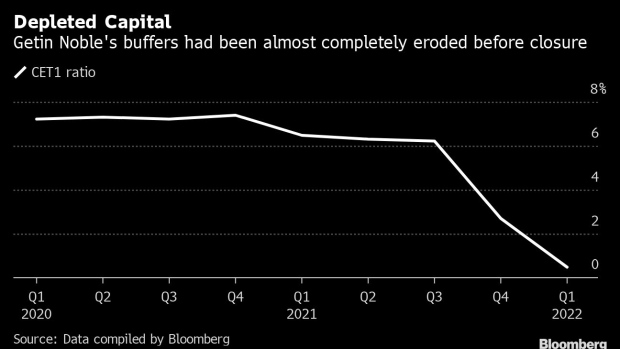

Concerns about Getin’s possible restructuring have been growing since at least 2020, when Poland orchestrated a takeover of Czarnecki’s other lender, Idea Bank SA by state-controlled Bank Pekao SA. The years of losses depleted most of its equity as its owner balked at injecting fresh capital.

The lender made a bid for revival in April on the back of rising interest rates, rolling out a plan to replenish capital over the next five years. Even so, the bank’s management consistently made lower provisions than its peers against future legal costs related to the foreign currency loans.

Financial Empire

Czarnecki built his financial empire through aggressive sale of high-margin financial products to retail clients. The strategy backfired, leaving his banks facing losses and a flurry of complaints. Getin has been suffering from lawsuits over Swiss-franc mortgages, while new legislation that allows borrowers to suspend payments on their zloty home loans dealt the bank another blow.

Deteriorating conditions of the two banks owned by Czarnecki have prompted regulators in recent years to ask for increased contributions to the industry’s guarantee and resolution funds. In 2022, several commercial banks paid additional 3.5 billion zloty to bolster the safety net that will now be used to finance the vehicle.

Getin Noble had around 45 billion zloty ($9 billion) in assets at the end of March, including 8.3 billion zloty of Swiss-franc loans. Those were excluded from the transaction because it would make the vehicle with the bank’s assets “unsellable,” BFG head Piotr Tomaszewski told reporters on a conference call on Friday.

The eight commercial banks involved in the rescue include PKO, Bank Pekao, Alior Bank SA, Bank Millennium SA, BNP Paribas Bank Polska SA, ING Bank Slaski SA, mBank SA and Santander Bank Polska SA. BFG plans to start seeking buyers for the vehicle, which the law requires to be sold within the next 2 to 3 years, Tomaszewski said.

(Adds context throughout)

©2022 Bloomberg L.P.