Nov 22, 2019

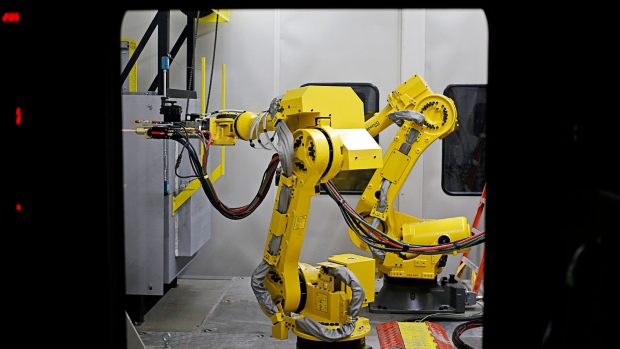

Populism Is Being Driven by Automation

, Bloomberg News

(Bloomberg) -- Subscribe to What Goes Up on Apple PodcastsSubscribe to What Goes Up on Pocket CastsSubscribe to What Goes Up on Spotify

As 2020 approaches, the financial industry is busy issuing global outlooks for the new year. Recession? Trade deal? Higher or lower bond yields? Wilmington Trust Corp. threw another major risk into the mix: the continued rise of populism.

Luke Tilley, chief economist at Wilmington and a former adviser with the Federal Reserve Bank of Philadelphia, joins this week’s “What Goes Up’’ podcast to discuss how next year will accelerate the “tug of war” between “productivity, populism and portfolios.”“The rise of populism around the globe… at its core is the rise in productivity,” Tilley says. “Firms have turned to robotics and artificial intelligence—all kinds of technology that increases their productivity. And one of the outcomes is that less of income, less of GDP, is actually going to the worker,’’ he says. “That tends to produce populist sentiment.’’

Also joining the show is Bloomberg’s Katherine Greifeld, who discusses the recent drop in bond yields and what’s arguably the most-boring foreign-exchange market since 1976.Mentioned in this podcast: Currency Doldrums Spur Complacency Risk That Could ‘Destroy Profits’ Bond Market’s Fate Hangs in Balance Before Trade-War Crunch Time

To contact the authors of this story: Michael P. Regan in New York at mregan12@bloomberg.netSarah Ponczek in New York at sponczek2@bloomberg.net

To contact the editor responsible for this story: Topher Forhecz at tforhecz@bloomberg.net, David Rovella

©2019 Bloomberg L.P.