Sep 3, 2021

Porter ready for takeoff as business travel lags amid crowded skies

, BNN Bloomberg

After an 18-month hiatus, Porter Airlines is set to take to the skies again next week, but will be doing so with more competition for a segment it specialized prior to the onset of COVID-19: the business traveller.

The Toronto-based airline plans to come back to service on Sept. 8 with flights leaving the city's Billy Bishop Airport, a key hub for Canadian business travellers who may be eager to work despite the ongoing pandemic uncertainty.

“When talking to CEOs, business travel is down a bit because they just Zoom in,” said Karl Moore, associate professor of Desautels Faculty of Management at McGill University, in an interview.

“A lot of executives say it’s harder to land new business if you can’t go visit the client. There’s something about going to a client’s site and seeing what they’re actually like.”

Porter operates Bombardier Inc.-built Q400 turboprop planes out of Billy Bishop, just a short hop from Bay Street, which helped the airline develop a core demographic of business travellers, said Moore.

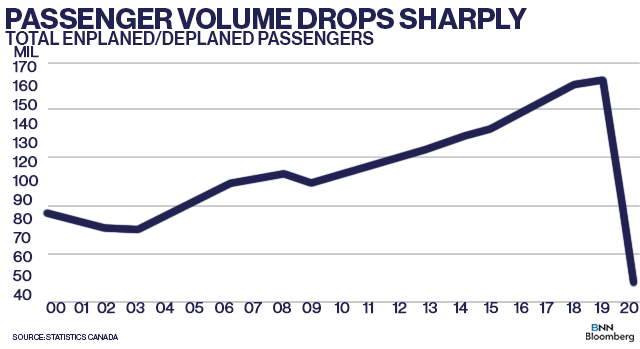

Porter hasn’t missed out on much during its absence as the total number of Canadian airline passengers in 2020 fell to 45.9 million, a drop of 71.8 per cent from 2019, according to Statistics Canada.

While Porter has been out of action longer than every other major Canadian airline, it also had the luxury of waiting out the various waves of COVID-19, since it doesn’t have the same shareholder pressures as rival Air Canada does, Moore said.

While demand for business-related flights is lower than it was in 2019, Moore said he doesn’t think the industry's outlook is as bleak as others might think.

Chris Murray, an airline analyst at ATB Capital Markets, agrees. While frequent flyers may be eager to get back on board, Murray thinks it could still be a while before the skies are chock-full of executives again.

“For the typical Porter type of traveller, a lot of those folks are still in a work-from-home mode, probably through the next couple months anyway,” said Murray in an interview.

“Our sentiment is the business traveller will come back. We may not see it really materialize maybe until sometime early next year.”

Murray noted the air travel restart kicked off with the so-called VFR crowd – visiting friends and relatives – followed by the longer haul vacation and leisure travel. He said the full recovery of business travel is likely the last piece of the puzzle, and added that Porter’s biggest challenge will be making sure it is adequately staffed to handle the ramp up in operations.

WON’T BACK DOWN

Air Canada, however, is doing what it can to dampen Porter’s fanfare, announcing plans Friday to resume flights between Toronto and Montreal via Billy Bishop on the same day as Porter’s restart.

“Our schedule enables travellers to conveniently fly between Montreal and Toronto Island Airport up to five times per day, linking the two key business and cultural centres as we continue to play our part to reinvigorate Canada's economy.” the company said in a release.

“Air Canada is not going to leave that Billy Bishop to Montreal route undefended,” said Murray. “That’s really the only one [route] Air Canada spends a lot of time competing directly with Porter on.”

LEARNING TO FLY (JETS)

That said, Porter is also making an attempt at moving in on Air Canada’s turf, announcing in July an order of 80 new jets from Brazilian plane-maker Embraer S.A. The plan is to eventually fly out of Toronto's Pearson International Airport to previously unreachable destinations in the U.S. and Caribbean, something that Porter has been looking to do for the past decade.

While being so close to downtown has been an asset for business travellers, the airline’s growth has always been restricted by its reliance on the turboprop, which can’t cover as much ground as a jet engine, Murray said. Jets are not permitted to land at Billy Bishop Airport due to government restrictions.

“It’s an opportunity for consumers,” said Moore. “If there’s more competition, prices and options will typically improve”.

While perhaps a boon to customers, Air Canada likely won’t see too much of an impact from increased competition out of Pearson.

“I think from Air Canada’s perspective, they’d never take a competitor like Porter lightly,” said Murray. “Having said that, its just one of several competitors they’ll be dealing with as we get travel restarted as now you’ve got Flair Airlines and several other regional carriers.”

Air Canada has no doubt benefited from Porter’s absence, but customers will come back, said Murray. He pointed to Porter’s strong brand and its loyal customers.

The real asset for Air Canada is international travel, and Murray indicated there are some promising signs on that front.

“Air Canada [recently] on its call talked about the fact that they’re starting to see bookings for the winter season to the Caribbean at levels above 2019. Certainly there’s a lot of pent-up demand.”