Mar 13, 2019

Pound Climbs Versus G-10 Peers on ‘Glass Half-Full’ Brexit View

, Bloomberg News

(Bloomberg) -- Optimism that the U.K. will avoid crashing out of the European Union is propping up the pound.

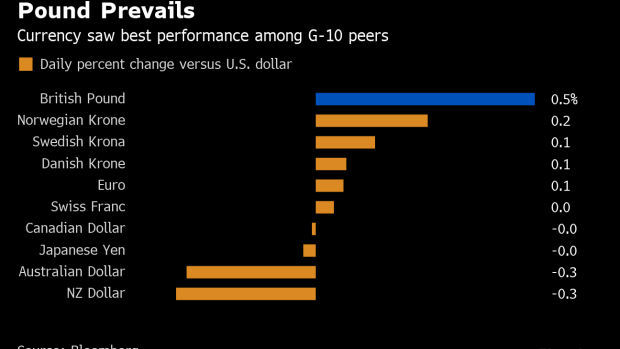

Sterling strengthened the most among the Group-of-10 currencies Wednesday ahead of a vote where analysts expect Parliament to reject leaving the EU without a deal. The pound extended this year’s gains versus the dollar to more than 3 percent, the best performance among G-10 currencies. U.K. government bonds declined as demand for safer assets waned, while the nation’s shares were little changed.

“The fact that it’s the best-performing currency year-to-date just gives validity to the view that sterling investors look at Brexit with a glass half full,” said Jane Foley, head of currency strategy at Rabobank. “As long as there are options on the table that suggest a hard Brexit will be avoided, sterling investors are encouraged.”

The pound advanced 0.5 percent to $1.3140 as of 8:43 a.m. in London on Wednesday. It climbed 0.5 percent to 85.90 against the euro, approaching the 84.76 level touched Tuesday that was the strongest since May 2017. One-week implied volatility in sterling against the dollar surged this week to levels last seen in the immediate aftermath of the 2016 Brexit referendum.

Yields on 10-year gilts climbed two basis points to 1.18 percent, the first increase in three days. Britain’s domestically focused FTSE 250 stocks index was little changed, after gaining 0.5 percent over the previous two sessions.

To contact the reporters on this story: Anooja Debnath in London at adebnath@bloomberg.net;Charlotte Ryan in London at cryan147@bloomberg.net

To contact the editors responsible for this story: Ven Ram at vram1@bloomberg.net, Anil Varma, Scott Hamilton

©2019 Bloomberg L.P.