Oct 22, 2019

Pound Drops as U.K. Lawmakers Back Brexit Deal, Reject Timetable

, Bloomberg News

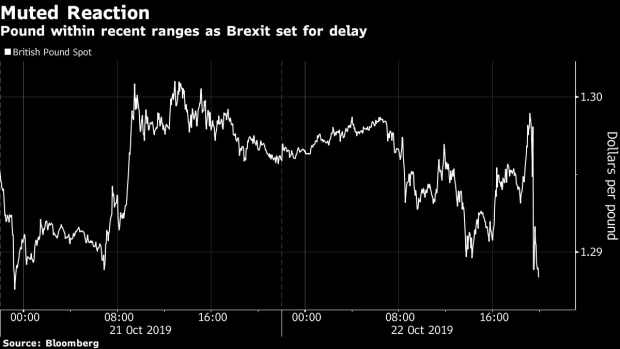

(Bloomberg) -- The pound weakened after U.K. lawmakers rejected Prime Minister Boris Johnson’s plan to fast-track his Brexit accord through parliament.

Britain’s currency dropped against all of its major counterparts, but the losses were contained after the government won an initial vote on the deal. Johnson opened the door to a short extension to his Oct. 31 deadline, saying he would pause legislation and go back to the European Union, after earlier threatening to throw out the deal if lawmakers rejected his plans.

“For now it seems the market is still generally expecting this is a setback, but not a fatal setback, to a negotiated Brexit,” said Jeremy Stretch, head of G-10 currency strategy at Canadian Imperial Bank of Commerce. “There hasn’t been a rapid uptick in no-deal pricing at this point,” he said, referring to a scenario where the U.K. would leave the EU with no divorce deal.

The U.K. currency had rallied more than 8% from September’s low as Johnson secured an agreement with the EU and then lawmakers then forced him to request an extension to the Oct. 31 deadline, reducing that no-deal risk.

Sterling dropped as much as 0.7% after the votes to $1.2869, after rallying Monday to touch $1.3013, the strongest level since May. Against the euro, it fell 0.4% to 86.39 pence.

--With assistance from Emily Barrett and Anooja Debnath.

To contact the reporter on this story: Charlotte Ryan in London at cryan147@bloomberg.net

To contact the editors responsible for this story: Paul Dobson at pdobson2@bloomberg.net, Anil Varma

©2019 Bloomberg L.P.