Dec 6, 2020

Pound Falls as Investors Question Progress in Brexit Trade Talks

, Bloomberg News

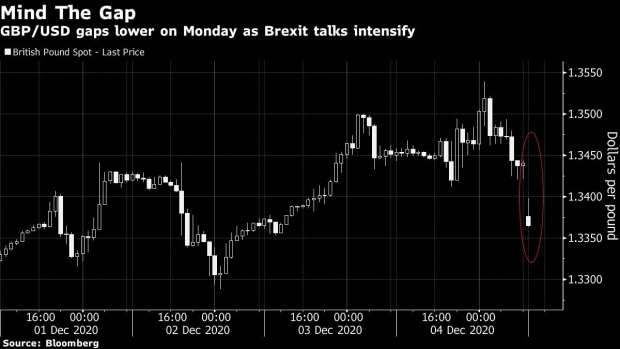

(Bloomberg) -- The pound dropped to start the trading week as investors questioned how close Britain and the European Union are to sealing a final Brexit trade agreement.

Sterling fell as much as 0.6% to $1.3363 in early Asia trading on Monday, with negotiators pushing to seal a deal before the end of the day. Signs are emerging of a possible compromise on the problem of fisheries, yet traders had speculated on a weekend deal and doubts are setting in.

“The main reason for the fall in the pound is again another kick of the can,” said Jordan Rochester, a currency strategist at Nomura International Plc. “The market is getting frustrated about a lack of transparency as to meaningful progress on a deadline that can be stuck to. The risk now is that optimism turns to pessimism and we have to hedge for a no-deal Brexit.”

Hopes that the EU and U.K. can reach a deal before Dec. 31 have boosted the pound by more than 8% against the dollar since June as traders leaned toward a last-minute resolution after more than four years of Brexit drama.

But traders are getting jumpy as the deadline for an agreement nears. Many investors expect the two sides to strike a deal, which leaves the currency vulnerable to any setbacks that could upend that assumption.

Analysts in a Bloomberg survey last month said they expected sterling to rise to $1.35 by mid-2021 in the event of a deal, noting though that any further upside could be limited due to the impact of the pandemic on the U.K. economy.

©2020 Bloomberg L.P.