Oct 3, 2022

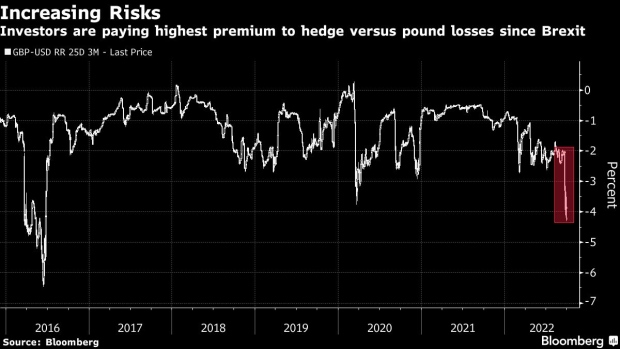

Pound Hedges Become Most Expensive Since Brexit as Fears Grow

, Bloomberg News

(Bloomberg) -- The pound has bounced back from a record low but the worst may be yet to come.

Three-month pound-dollar risk reversals, which measure the premium of hedging against a drop in sterling, jumped to the highest since the June 2016 Brexit vote on Friday, signaling traders anticipate further losses. The UK currency slid as much as 0.8% Monday, and options show there’s a 24% chance it will decline to parity by year-end.

The pound slid to an all-time low of 1.0350 last week as the UK government’s tax-cut plan fueled fears of worsening public finances and quicker inflation. While the Bank of England’s bond purchases on Wednesday helped the currency pull out of its nosedive, analysts are forecasting more declines after Prime Minister Liz Truss vowed to stick to the fiscal policy.

“The pound is on borrowed time” without some reassurances on the fiscal front, Jane Foley, a strategist at Rabobank in London, wrote in a research note. A decline to parity can’t be ruled out, “dependent on the decisions taken by the UK government,” she said.

The pound was 0.2% lower Monday at $1.1145 after rallying 4.5% on the four days through Friday.

Truss said she’s determined to follow through with her plans for massive tax cuts because she believes they will make the country more successful, according to an interview published in the Telegraph.

The pound’s volatility “serves as a salutary reminder of the need to deliver credible policy, particularly in the current climate of high inflation and asset price weakness,” Australia & New Zealand Banking Group Ltd. strategists Brian Martin and Mahjabeen Zaman wrote in a note. “UK policy setters need to get ahead of market anxiety.”

©2022 Bloomberg L.P.