Jun 13, 2018

Pound Holds Loss After Inflation Data as Brexit Tension Simmers

, Bloomberg News

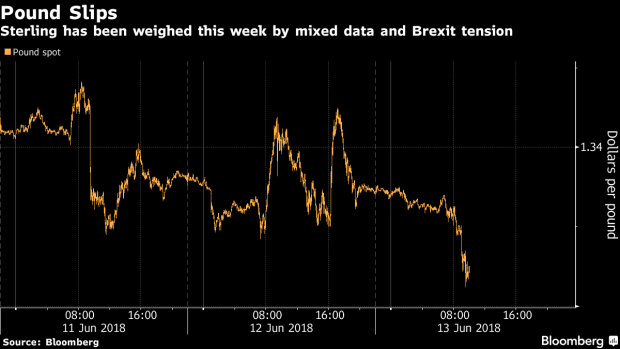

(Bloomberg) -- The pound fell for the fourth day, the longest losing streak in more than a month, as stagnant U.K. inflation added to pressure on the currency amid political uncertainties.

Sterling has declined this week, weighed down by political tensions over Prime Minister Theresa May’s Brexit legislation and mixed economic data. Wednesday’s report showed that an increase in auto-fuel prices helped arrest a decline in inflation, leaving opinion divided over when the Bank of England will raise interest rates next after disappointing production and wage-growth data earlier in the week.

“Since headline inflation isn’t picking up, we still see material downside risks to the U.K. inflation outlook and don’t buy the 50 percent probability of an August hike,” said Andreas Steno Larsen, a currency strategist at Nordea Bank AB. This is “ultimately more negative for the pound.”

One-week option volatility on the U.K. currency snapped a three-day decline amid political tensions. Prime Minister May has until Friday to make good on a promise to rebels within her party over Parliament getting a vote on the final deal, while also keeping Brexiteers on side. The concessions she is likely to make should reduce the possibility of the pound-negative scenario of Britain leaving the European Union without a deal, according to Rabobank analyst Jane Foley.

The pound fell 0.4 percent to $1.3324, taking this week’s loss to 0.6 percent. It weakened 0.4 percent to 88.19 pence per euro. The yield on U.K. 10-year government bonds declined three basis points to 1.37 percent.

To contact the reporter on this story: Charlotte Ryan in London at cryan147@bloomberg.net

To contact the editors responsible for this story: Ven Ram at vram1@bloomberg.net, Anil Varma, Keith Jenkins

©2018 Bloomberg L.P.