Dec 7, 2018

Pound May Be Too Cheap to Plunge on Brexit Deal Rejection

, Bloomberg News

(Bloomberg) -- The pound’s historically cheap levels could protect it from the worst if British lawmakers reject the Brexit divorce deal next week.

Sterling has dropped 15 percent since the Brexit vote in June 2016, leaving it trailing its Group-of-10 counterparts on various measures of fair value. With Theresa May expected to see her deal rejected when it goes before Parliament on Dec. 11, strategists say some disappointment has already been priced in, so the currency is unlikely to see a significant drop.

“Currency markets appear priced for the Withdrawal Agreement vote failing in Parliament on 11 December by a relatively wide margin,” wrote Barclays Plc strategists including Marvin Barth in a note. It would take losing the vote by a margin of more than 75 lawmakers to hurt the pound, according to Barclays.

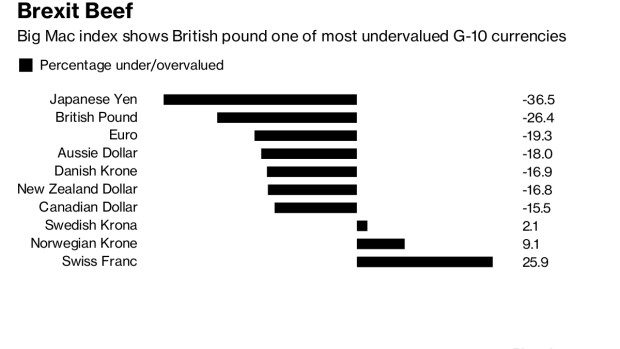

Here are charts showing sterling’s value versus its peers:

The Big Mac Index measures purchasing power across different countries by using the price of a McDonalds burger. On this measure, the pound is one of the most undervalued currencies, trailed only by the yen.

King dollar has reigned over all currencies over the past six months but the pound has been one of the worst hit. One of the main arguments made by strategists for the pound being undervalued is how far it has dropped already.

“There is clearly a discount in it on the fears of a disorderly exit, an excessive one in my opinion,” said Patrick Perret-Green, head of research at AdMacro Ltd.

To contact the reporter on this story: Charlotte Ryan in London at cryan147@bloomberg.net

To contact the editors responsible for this story: Ven Ram at vram1@bloomberg.net, Neil Chatterjee, Scott Hamilton

©2018 Bloomberg L.P.