Nov 1, 2018

Pound rallies even as report on post-Brexit access refuted

, Bloomberg News

The pound headed for its biggest two-day rally in nine months, undeterred by a denial on how the post-Brexit landscape would look.

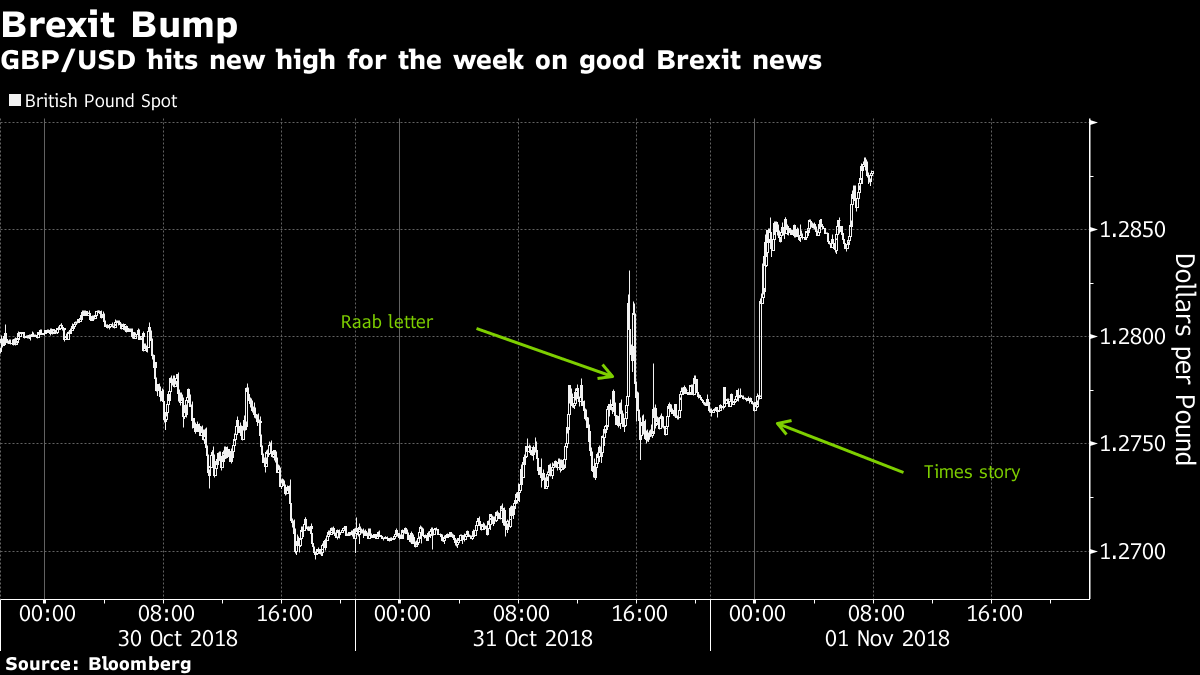

Sterling surged in Asian hours after the Times reported a Brexit deal has been reached for banks, and barely trimmed gains as British and European officials said the story was unsubstantiated. Investors have brought forward expectations for an interest-rate hike to next year, just before the Bank of England announces its policy decision and inflation outlook later Thursday.

“The pullback in the pound is a great favour for those wanting to get in on the long trade,” said Jordan Rochester, an analyst at Nomura International Plc. “I doubt this will be a long lasting move lower in the pound.”

The market’s positioning is still heavily short on sterling amid fears of a no-deal Brexit, leading to outsized moves on positive Brexit headlines. Options have been suggesting a rebound in the currency was due, after its worst month since May last month.

The pound was up 0.9 per cent at US$1.2885 at 11:22 a.m. in London, to take gains over two days to 1.4 per cent, the most since February. Ten-year gilt yields rose two basis points to 1.46 per cent and the FTSE 350 Banks Index gained 1.3 per cent. The currency jumped on Wednesday and gilts were put under pressure after a letter was published showing U.K. Brexit Secretary Dominic Raab expected a deal to be finalized by Nov. 21.

Carney Test

The optimism over Brexit negotiations may complicate matters for gilt traders and BOE Governor Mark Carney ahead of the policy meeting Thursday. U.K. money markets have moved forward their pricing for the next rate hike to November 2019, from February 2020 on Tuesday.

That is still later than markets were expecting just a month ago and traders will be watching to see what Carney says on the risk of no deal as the Brexit deadline comes closer.

“The BOE Governor will likely reiterate his warning about the very damaging growth impact of a ‘no-deal’ Brexit,” said Credit Agricole SA head of G-10 currency strategy Valentin Marinov in a note. “Given that pound sentiment has taken quite a beating of late, Carney’s comments could reverberate strongly and put the latest bounce in the pound to the test.”