Aug 3, 2019

Pound Seen Hitting 34-Year Low If Johnson Drags U.K. to No-Deal

, Bloomberg News

(Bloomberg) -- The pound will tumble to the lowest level since 1985 if the U.K. leaves the European Union without a deal, a prospect that looks more likely now than six months ago, according to a Bloomberg survey of analysts.

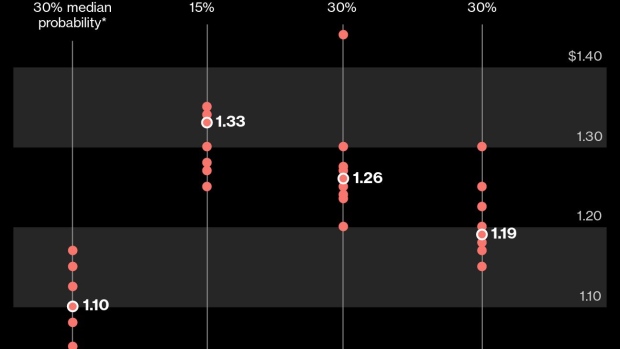

There is now a 30% chance that Britain will exit the bloc in October without a divorce agreement, the poll of 13 banks showed. That’s more than three times the level from a similar survey in February. Such an outcome would drive down sterling by more than 9% to $1.10, a level not seen in 34 years, according to the median response.

The latest survey also shows that with just under three months until the Brexit deadline, the possibilities remain open. Strategists assign equal probabilities to a no-deal exit, a further delay to the departure date as well as the prospect of a general election being called before Oct. 31. A deal being struck by the deadline is seen as the least likely outcome with just a 15% chance.

“It feels very much that the market is now fully on board with a hard Brexit risk rising and rising,” said Luke Hickmore, a money manager at Aberdeen Standard Investments. “The risk of course is that the smell of a currency crisis will start to rise. I was working in 1992 during Black Wednesday and do not want to see that shambles all over again.”

Sterling tumbled nearly 10% during the week of Black Wednesday in September 1992, when the U.K. was forced to withdraw from the European exchange-rate mechanism.

‘Moment of Circularity’

The pound has slid almost 7% since the U.K. deferred the original end-March Brexit deadline, to about $1.2140 on Friday, with investors pricing in higher odds of a disorderly Brexit after the ruling Conservative Party’s leadership contest ended with the election of Brexiteer Boris Johnson. A sterling slump to $1.10 in a no-deal scenario would mark a return to levels last seen during the dollar bull run of 1985.

Should sterling slide toward those levels again, focus will be on how the Bank of England will support the currency -- but the central bank said Thursday that it was “highly unlikely” it would intervene. Governor Mark Carney said a change in the value of sterling was “part of the shock-absorbing function”.

Johnson issued an ultimatum to the EU this week, saying he would not meet the bloc’s leaders for talks unless they shift their position. While there is no majority support in Parliament for a no-deal Brexit and lawmakers have said they would seek to block Johnson from pursuing this outcome, strategists see a risk that it happens by accident.

“We’re in this peculiar moment of circularity in the Brexit echo chamber,” said Ned Rumpeltin, European head of currency strategy at Toronto-Dominion Bank. “The risk, of course, is that both sides become completely entrenched and unable to escape from the corners each has backed itself into.”

Election Risk

The other possibility worrying investors is that Johnson will call a general election. The pound could fall to $1.19 in this scenario, with recent polling suggesting the outcome of a vote may not return a majority for the Conservatives, according to electoral analyst John Curtice.

It’s not all bad news though. If a no-deal Brexit can be avoided, a delay or a deal are the most positive outcomes for the pound, with the former seen pushing the currency up to $1.26 and the latter to $1.33. BlackRock International’s Rupert Harrison sees the pound having an even bigger jump on a deal, though it isn’t his base case.

“Any negotiated outcome that can get through the House of Commons is a big upside surprise,” said Harrison, a portfolio manager and chief macro strategist at BlackRock. “We certainly think we can see cable up through $1.40” in such a scenario, he said.

--With assistance from Anooja Debnath and Hayley Warren.

To contact the reporters on this story: Charlotte Ryan in London at cryan147@bloomberg.net;John Ainger in London at jainger@bloomberg.net

To contact the editors responsible for this story: Ven Ram at vram1@bloomberg.net, Anil Varma

©2019 Bloomberg L.P.