Sep 13, 2019

Pound Set for Best Week Since May as Brexit-Deal Hopes Resurface

, Bloomberg News

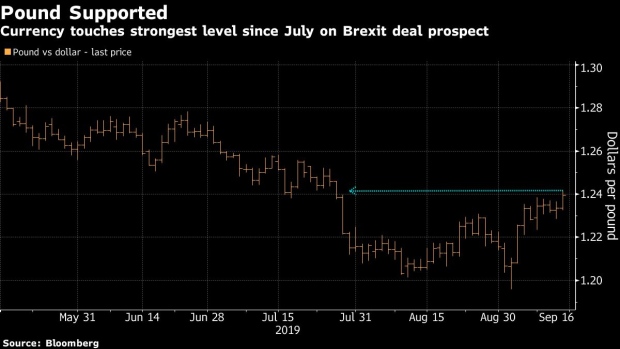

(Bloomberg) -- The pound headed for the biggest weekly gain since May against the dollar after reports of U.K. politicians softening their stance on Brexit rekindled optimism about a potential deal. Gilts fell as demand for the safety of government debt waned.

Sterling led Group-of-10 currency gains after the Times reported that the Democratic Unionist Party, an ally of the ruling Conservative Party, would accept a new agreement to replace the contentious Irish backstop. The pound, which also benefited from broad dollar weakness, extended its rally even after some DUP members pushed back against the news.

The news “was denied a bit later on but seems to have caught markets by surprise,” said Valentin Marinov, the head of G-10 currency research at Credit Agricole. “I think markets smell there could be a deal after all.”

The pound climbed as much as 0.9% Friday to $1.2443, the strongest level since July 26, and was up 1.3% in the week. It appreciated 0.6% on the day to 89.42 pence per euro. The yield on 10-year gilt climbed as much as five basis points to 0.723%, its highest since July.

“There’s been some optimism over a Brexit deal involving an all-Ireland backstop in recent days,” said Lee Hardman, a currency strategist at MUFG. “More immediate no-deal Brexit and U.K. recession risks have both eased recently, encouraging a relief rally for the pound. Broad-based dollar weakness on the back of U.S.-China trade talk optimism is helping to lift cable as well.”

To contact the reporter on this story: Anooja Debnath in London at adebnath@bloomberg.net

To contact the editors responsible for this story: Ven Ram at vram1@bloomberg.net, Anil Varma

©2019 Bloomberg L.P.