Jul 23, 2019

Pound Steadies as Boris Johnson Wins U.K. Prime Minister Race

, Bloomberg News

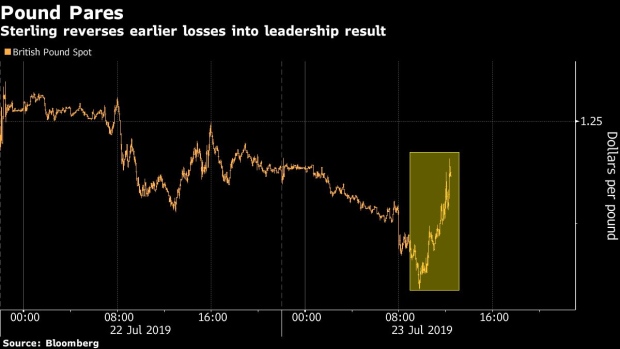

(Bloomberg) -- The pound halted this week’s losses after Boris Johnson was set to become the next U.K. prime minister, in a result that was largely a foregone conclusion for investors.

Sterling erased an earlier decline after Johnson’s decisive win over rival Jeremy Hunt, which was seen as giving him scope to promote Brexiteers to the cabinet. The market’s attention will now switch to who the chancellor will be.

“A Boris Johnson win is no surprise,” said Neil Jones, head of hedge-fund currency sales at Mizuho Bank Ltd. “What the pound market will be all ears on now is any hints of fiscal stimulus, tax cuts, the end of austerity and any projects.”

The pound was little changed at $1.2479 by 12:33 p.m. in London, after touching the lowest since July 17 earlier Tuesday. U.K. government bonds also steadied, with 10-year yields flat at 0.71%. The pound has already slid more than 2% since the Conservative Party leadership contest began in May, with traders factoring in a greater risk of a no-deal Brexit.

After Johnson’s victory, the EU’s chief Brexit negotiator Michel Barnier said he looked forward to working constructively with the next prime minister, who has promised to deliver Brexit by Oct. 31 “do or die.”

Sterling slid earlier in the session after Bank of England hawk Michael Saunders said Brexit vulnerabilities may prevent it from raising interest rates. A smooth departure from the EU, which the BOE’s forecasts assume, is very uncertain, policy maker Saunders said in a Bloomberg interview. Brexit risks may stop the BOE from raising rates even if its forecasts imply a need to do so, he said.

To contact the reporter on this story: Charlotte Ryan in London at cryan147@bloomberg.net

To contact the editors responsible for this story: Ven Ram at vram1@bloomberg.net, Neil Chatterjee, William Shaw

©2019 Bloomberg L.P.