May 18, 2022

Pound Tumbles on Bets the Bank of England Will Be Boxed Into a Corner

, Bloomberg News

(Bloomberg) -- The pound tumbled back near a five-year low as traders speculated that the Bank of England will struggle to rein in inflation and avoid a recession.

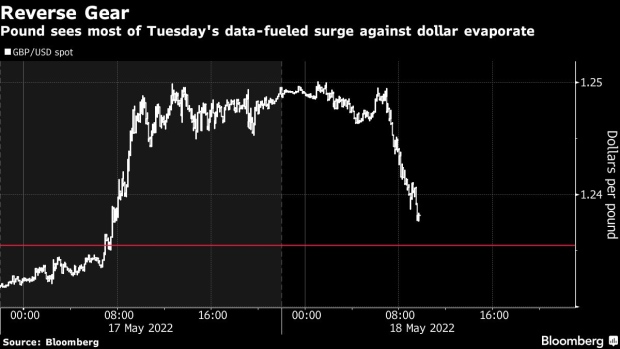

The British currency slid 1% on Wednesday to $1.2372, snuffing out most of yesterday’s rally. The moves came on the back of data showing UK consumer prices rose to 9% in the year through April, a 40-year high.

The inflation report wasn’t as bad as most economists expected and took the prospect of higher rate hikes, which would have helped the currency, off the table. At the same time, price pressures are bound to worsen the strain on the UK economy.

“With the spectre of stagflation looming, there are expectations that the Bank may be forced to take more of a softly-softly approach,” said Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown.

UK Inflation Jumps to 9% as Prices Surge Most Since Thatcher Era

The pound is the second-worst performing major currency over the last three months and was bottom of the pile today.

The currency rebounded on Tuesday on the back of labor market data showing unemployment is the lowest in decades. It’s now more-than-erased the bounce against the euro and is almost back to square one against the US dollar

“Yesterday’s wage data really was impressive, but inflation fails to properly surprise today,” said Jordan Rochester, a currency strategist at Nomura, who recommends shorting the pound against the dollar. “We’d probably need more of the dovish MPC members to make half-point rate hike comments to boost sterling further.”

While the BOE started its hiking cycle earlier than major peers, it has adopted a gloomier tone as it warns of a prolonged period of stagnation or even recession. The UK central bank, independent for over two decades, is also facing political attacks, piling pressure onto policymakers.

“The BOE reaction function has become less transparent and monetary policy more at risk of perceived politicisation,” Robert Wood, a UK economist at Bank of America Corp., said in a report.

©2022 Bloomberg L.P.