Jul 11, 2019

Powell Gives Emerging-Market Peers a Strong Reason to Cut Rates

, Bloomberg News

(Bloomberg) -- Federal Reserve Chairman Jerome Powell gave emerging-market central banks another solid reason to lower interest rates.

His signal on Wednesday that the Fed is preparing to lower borrowing costs for the first time in a decade is supportive of higher-yielding currencies, which in turn allows monetary authorities in developing markets to ease policy without triggering an exodus of capital.

That’s an opportunity for policy makers to bolster their economies against slowing growth, subdued inflation and simmering trade tensions that are hurting investment and manufacturing. Across Asia and Europe, factory activity shrank in June while the U.S. showed only meager economic expansion.

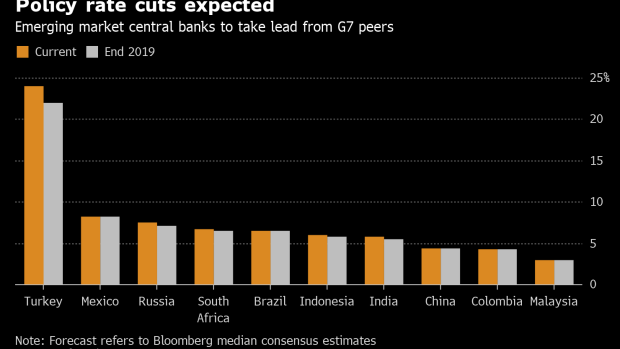

Central banks in Indonesia, South Africa, South Korea and Turkey are among those scheduled to make policy decisions over the coming weeks. Some of them across emerging markets have already shifted gears this year, with Russia, Chile, Malaysia, India and the Philippines lowering rates in recent months.

“Powell’s testimony and likely 25 basis-point easing this month is likely to help spur emerging-market central banks to cut rates,” said Mitul Kotecha, a senior emerging-markets strategist at TD Securities in Singapore.

Powell’s comments may give Bank Indonesia the impetus it needs to move after leaving its benchmark rate unchanged at 6% this year. It raised interest rates six times last year by a total of 175 basis points amid an emerging-market rout, and has been proceeding cautiously this year to avoid undermining the currency.

South Korea’s central bank, which also meets next week, is expected to cut over coming months.

“The tone of the comments was more dovish than anticipated,” said Stuart Ritson, portfolio manager for emerging-market debt at Aviva Investors in Singapore. “It increases the chance we see the start of an easing cycle in Indonesia next week.”

The People’s Bank of China is already in stimulus mode, though has so far steered clear of adjusting its benchmark rate. Instead, the PBOC is leaning on a varied tool box to push credit into the economy. Governor Yi Gang told Bloomberg News in June that the central bank has “tremendous” policy room.

The nation’s producer price inflation slowed to zero in June from a year earlier, the weakest reading in almost three years, stoking expectations that more easing is on the way.

“Financial conditions in China are now firmly in easing territory and filtering through to the real economy,” Shaun Roache, Asia-Pacific chief economist for S&P Global Ratings, wrote in a note. “This careful easing should be enough to put a soft floor under China’s growth later this year.”

In other regions, Turkey will be in focus after President Recep Erdogan dismissed the central bank governor last weekend. Given Erdogan’s push for lower interest rates, the question now is how fast will monetary policy ease when policy makers meet on July 25.

Erdogan has said lower rates are needed to boost an economy that entered its first recession in a decade this year. The one-week repo rate has stayed at 24% since September when it was raised by a total of 625 basis points.

South Africa’s stagnant growth has raised investors’ hopes of a rate cut when authorities meet on July 18. The central bank has held its key rate at 6.75% since a 25-basis-point increase in November and its scope to cut is limited by a current-account deficit.

What Bloomberg Economists Say:

The Fed’s signaled easing will make it easier for emerging market central banks to lower rates. This comes at a time when EMs are weakening and in need of policy space. China has been deep in an easing cycle. Many EM central banks, including those in India, Malaysia and the Philippines have cut rates this year on growth concerns. Some central banks, for example Indonesia, have been hesitant on concerns over currency pressures.

--Chang Shu, Asia economist

Emerging-market assets cheered Powell’s remarks. The MSCI index of emerging-market currencies rose 0.4% in Asian trade on Thursday, extending Wednesday’s 0.1% gain. The MSCI gauge for developing-nation shares advanced for a second day, adding 0.8%.

Traders have stepped up bets that the Fed will cut at its next meeting on July 30-31, possibly by half a percentage point, though the consensus is for a quarter-point cut.

“The dovish Fed now removes the last hurdle for Asian central bank to ease,” said Jason Daw, the head of emerging-markets strategy at Societe Generale in Singapore. “The market tends to front-load a higher level of Asia central bank easing than is ultimately delivered in the cuts themselves.”

--With assistance from Marcus Wong and Tomoko Yamazaki.

To contact the reporters on this story: Enda Curran in Hong Kong at ecurran8@bloomberg.net;Lilian Karunungan in Singapore at lkarunungan@bloomberg.net

To contact the editors responsible for this story: Nasreen Seria at nseria@bloomberg.net;Tomoko Yamazaki at tyamazaki@bloomberg.net

©2019 Bloomberg L.P.