Aug 22, 2022

Powell 'put' likely to be about removing rate cuts from the outlook: Larry Berman

By Larry Berman

Larry Berman's Educational Segment

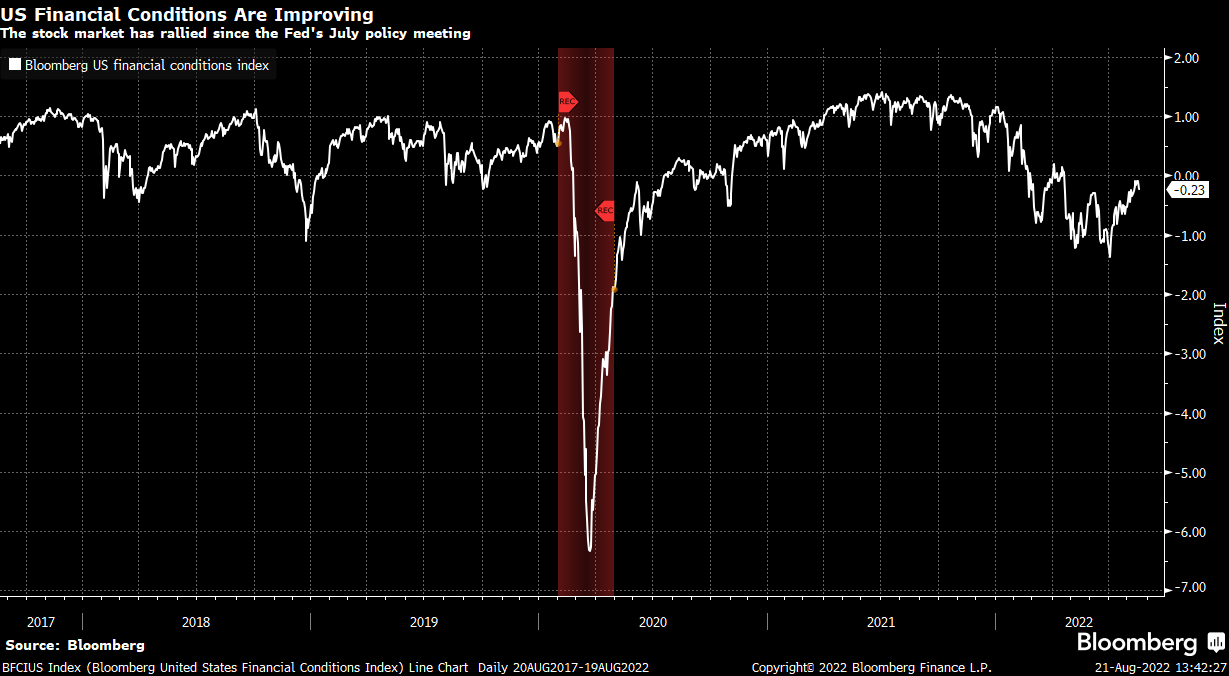

We think that Powell will do his best this week to regain credibility of the FOMC as an inflation fighter having fallen so far behind the curve earlier this year and last. Several FOMC members went out of their way since the minutes hit (August 17. 2 p.m.) to remind investors they have not hit a pivot point. Some went as far to say that they would even risk an economic downturn to keep inflation at bay. Historically the “Fed put” was about restoring financial conditions. The main indicator in most financial conditions indexes is the S&P 500. It’s better to say we are supporting financial conditions that equity risk premiums. Our first chart is the Bloomberg financial conditions index. It’s a standard deviation type indicator. A reading of zero is trend, a negative is tighter and a positive is easier. The more volatile and more extreme the swings, the more it will impact the magnitude of the deviation from zero. The recent correction was more intense than the 2018 shock led by the last rate hike concern. This time their job is magnitudes harder given inflation risks.

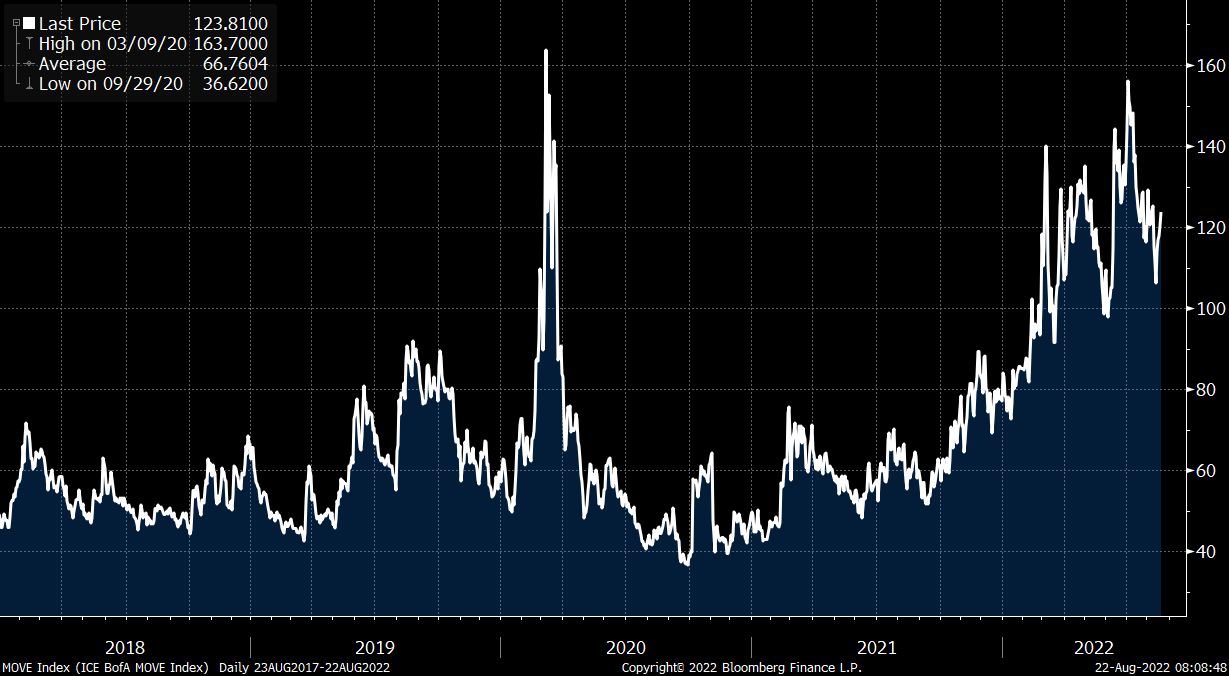

When most talk about volatility, they are referring to the VIX, the well-known benchmark for US equity market risk. The MOVE index (the bond market VIX) is a yield curve weighted measure of one month T-Bill and T-Bond options volatility. It notably ticked higher last week, but not higher than the July peak. For the FOMC to regain inflation fighting credibility, they are going to have to walk a tight line between financial conditions and longer-term inflation expectations becoming unhinged (read bond volatility). Because of inflation issues, the bond market has (temporarily) lost its negative correlation (balance) versus equities and other risk assets. It’s clear that the increased volatility in bonds make them a much riskier asset class than in 2018.

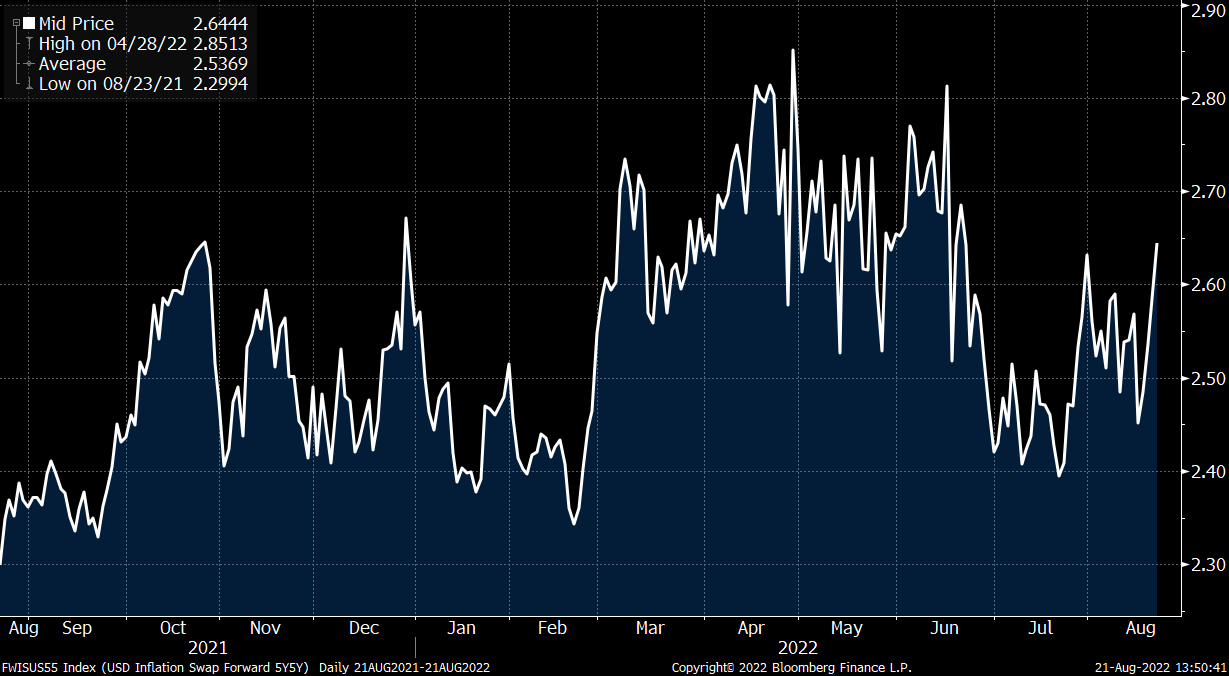

In the third chart we are looking at the two year inflation swap and it remained relatively stable post FOMC minutes as the market seemed to think the Fed did not offer up a dovish pivot. The market based price of inflation two years from now is a bit above three per cent. The five year measure in the next chart ticked notably higher but has not broken recent extremes. Many investors will be look at these (as will the FOMC) following Powell’s 10 a.m. speech on Friday. The fact that longer-term inflation expectation ticked higher, but is still well below the two year measure tells us the market believes the Fed will be able to keep longer-term inflation expectations contained. A dovish pivot at this point would push these higher and that would be really bad for risk assets. Keeping them contained is Powell’s goal on Friday. Those looking for a Dovish pivot will likely be disappointed.

Getting inflation from nine per cent to six per cent by mid 2023 will be easy. Getting it to three per cent by the time we get to the 2024 election will be very hard without crushing demand. Crushing demand will not fix the global supply chain rebalancing. We should be ready for inflation to be stickier for the next few years and asset markets should respond accordingly.

Last week we bought some tail risk protection in our portfolios (where we had a mandate to do it.) It’s rare that we see the combination of relative cheap put protection with a high risk that risk premiums expand (assets fall). Powell has learned from the FUBAR in the December 2018 FOMC rate hike press conference Q&A. He’s been very good at sending the message. Will it be the old Fed put to protect financial conditions or the new Fed narrative about being a good old inflation hawk? We are betting hawk. Will be back in September to see the results. In the mean time, follow me on social media for more timely thoughts.

Follow Larry online:

Twitter: @LarryBermanETF

YouTube: Larry Berman Official

LinkedIn Group: ETF Capital Management

Facebook: ETF Capital Management

Web: www.etfcm.com