Nov 22, 2021

Powell’s Fed Era 2.0 Tees Up Tough Choices, Unforgiving Politics

, Bloomberg News

(Bloomberg) -- Jerome Powell faces a plethora of politically tricky economic problems with little precedent in the Federal Reserve’s 107-year history now that he’s been tapped to lead the central bank for another four years.

The thorny topics crowding the Fed chair’s inbox run the gamut, from managing an economy coming out of a once-a-century pandemic to deciding whether to create a digital dollar. The stakes are high: a misstep on any of a number of fronts could upend the economic expansion and trigger a recession.

Read more: Biden Keeps Powell as Fed Chief, Names Brainard Vice Chair

“The Fed is facing the most difficult period in its history” since Paul Volcker was chair more than a quarter century ago, Bloomberg Opinion columnist and former central bank official Claudia Sahm said.

Making the job even tougher: A highly partisan political milieu in which the Fed is increasingly seen as no longer above the fray and in which its reputation has been besmirched by a trading scandal involving a few policy makers.

Overseeing the Economy

This is always at the top of the inbox of any Fed chair. But what’s different this time is that the central bank is confronting a policy quandary not seen in decades.

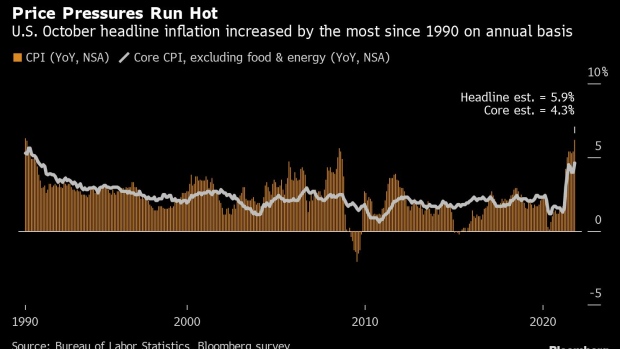

Inflation is running well above the Fed’s 2% target, while the central bank is falling short of its maximum-employment objective. That’s a combination policy makers didn’t envisage when they adopted a new monetary policy framework in 2020 aimed at lifting inflation after years of below target price rises.

Amid the acceleration in price growth, the Fed looks on course to consider a more rapid drawdown of its mammoth $120-billion-per-month bond-buying program just weeks after it instituted a plan to scale the purchases back in a methodical manner.

Last week, Vice Chair Richard Clarida, Governor Christopher Waller and St. Louis Federal Reserve Bank President James Bullard signaled that the topic of a faster taper might be on the table when the Federal Open Market Committee meets Dec. 14-15.

A faster reduction in the so-called quantitative easing program would give policy makers an earlier opportunity to lift interest rates from near zero should they deem that necessary to keep the economy from overheating.

Ensuring Financial Stability

The Fed’s super-lax monetary policy has encouraged investors to take on more risk and pushed stock, housing and other asset prices into the stratosphere. The result is what Fed staffers have called “notable” vulnerabilities that leave the financial system susceptible to breakdown.

The explosive growth of cryptocurrencies and related assets also poses potential risks to the system, particularly the rise of stable coins as an alternate means payment to the dollar.

Create a Digital Dollar?

The takeoff of stablecoins is putting pressure on the Fed to follow the lead of China and issue its own digital currency.

Proponents argue that would help expand access to the financial system to the millions of Americans without a bank account and speed up and lower the cost of transactions. Opponents warn it would risk hollowing out the banking system as money was yanked out of the financial institutions and parked in digital dollars at the Fed.

It’s “a battle for the soul of the financial system,” said former Bank for International Settlements economic adviser and digital-dollar skeptic Stephen Cecchetti.

A decision to go ahead would probably require at least the tacit approval of lawmakers, potentially enmeshing the Fed in politically treacherous terrain.

Repairing the Fed’s Tarnished Reputation

That terrain will be all the more trickier to traverse after the central bank’s reputation as straight-shooting economic steward took a knock with the revelation that some policy makers traded in financial securities while the Fed was aiding the markets and the economy.

The news led to the resignations of the Dallas and Boston reserve bank presidents and the adoption of strict new curbs on trading by top Fed officials, including a ban on the buying of individual stocks and bonds.

This “is a start, but we can’t let up now,” Senate Banking Committee Chair Sherrod Brown, the Ohio Democrat who leads the panel that oversees the Fed, said in a statement after the restrictions were announced on Oct. 21. “The American people need to be able to trust that the Federal Reserve works for them.”

Also hanging over the Fed: an ongoing probe into the trading scandal by its internal watchdog.

Climate Change

The Fed is already caught up in a tug-of-war between Democrats and Republicans over what it can and should do to combat global warming.

After years of lagging other central banks, the Fed has ramped up its research on climate change and is actively considering the risks that a warming planet poses to financial stability. In the past year, bank officials created a climate committee, joined a key global group of central banks on the issue and began working with the Treasury Department on Biden’s climate executive order.

But that has failed to appease progressive Democrats, some of whom opposed Powell’s renomination before it was announced. They want the Fed to be far more active in fighting climate change. Some Republicans, meanwhile, have accused the central bank of mission creep.

Inequality

The Fed is also caught in the political crosshairs in the debate about income and racial inequities.

Policy makers have been far more forthright than in the past about the deleterious effects such disparities can have on the economy. And, as part of their new monetary framework, they’ve broadened their definition of their maximum employment goal to make clear they’re seeking “broad-based and inclusive” job gains.

But they’ve faced criticism from the left for contributing to the very income inequality they decry by pursuing an aggressive quantitative-easing program that has pumped up the prices of stocks and other assets mainly held by the rich. And they’ve been attacked for being a largely White man’s club short on racial and gender diversity.

Biden could address these issues in coming weeks. He will announce his pick for Fed vice chair of supervision along with additional nominations for open seats on the Board of Governors beginning in early December, the White House said Monday.

Democrats have also been urging the central bank to improve diversity among the Fed’s leadership with its picks of presidents to head the Dallas and Boston reserve banks, while Republicans are warning it to not be swayed by political pressure.

©2021 Bloomberg L.P.