Jan 27, 2022

Powell’s Hawkish Determination Is Firing Up Bets on the Dollar

, Bloomberg News

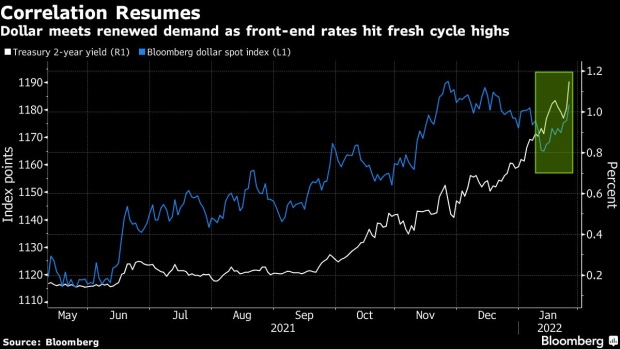

(Bloomberg) -- A more hawkish and less predictable Federal Reserve is adding more fuel to a rally in the dollar.

An index of the greenback’s strength jumped to a five-week high on Thursday as investors said Fed Chair Jerome Powell’s comments reveal a surprisingly aggressive stance to tightening monetary policy.

And the options market shows traders are expecting the rally to continue. Risk reversals, a barometer of market sentiment and positioning, indicate that bullish wagers over the next month trade at the widest premium since late November.

“We haven’t had policy surprises from the Fed for a long period of time,” said Steven Barrow, head of FX strategy at Standard Bank. “That creates a big risk for currencies and support for the dollar.”

Powell Pulls the Rug Out From Under Skeptics Feet: Trader Talk

Historically, dollar strength has tended to wane as the Fed settled into a more predictable hiking cycle. But this time looks different.

Strategists say Powell is continuing to surprise the market with messaging that paves the way for faster rate hikes. On Thursday, he said the central bank would need to be nimble as it aims to tame inflation that is running at its highest level in nearly 40 years.

“Powell did not pull any punches on the potential need to tighten aggressively,” TD Securities’ strategists including Jim O’Sullivan wrote in a note. “This supports our bias for further USD resilience early this year.”

The greenback climbed to a fresh one-month high on Thursday, following U.S. economic data that showed the strongest quarterly growth in over a year. The Bloomberg Dollar Spot Index added 0.5%, rising for a fourth day.

BNY Mellon’s FX and macro strategist John Velis says real yields and the U.S. dollar will keep moving up together until at least the first Fed rate rise. Money markets now expect five hikes from the Fed in 2022, with the first coming in March.

Traders Ramp Up Bets to See Five Federal Reserve Hikes This Year

Some analysts say the dollar won’t be able to bask in the Fed’s reflected glory forever. Central banks including the Bank of England and the Reserve Bank of New Zealand have also started raising rates, which could eventually make their currencies more attractive as a relative value play, said Stuart Bennett, head of G-10 FX strategy at Santander.

Other strategists are focusing on euro weakness as the flipside of dollar strength. The euro lost 0.8% to $1.1150 on Thursday, the lowest level since June 2020.

According to George Saravelos, global head of FX research at Deutsche Bank, it has further to go. Euro-dollar is on track to breach $1.10 if the Fed continues to dominate the price action, he said.

(Updates prices in 8th paragraph)

©2022 Bloomberg L.P.