Jul 14, 2021

Powell says achieving 'substantial further progress' a ways off

, Bloomberg News

The strong inflation environment is going to be with us for a while: Wells Fargo's Sarah House

Federal Reserve Chair Jerome Powell said the U.S. economic recovery still hasn’t progressed enough to begin scaling back the central bank’s massive monthly asset purchases, while adding inflation is likely to stay high in coming months before moderating.

“At our June meeting, the committee discussed the economy’s progress toward our goals since we adopted our asset purchase guidance last December,” Powell told the House Financial Services Committee Wednesday. “While reaching the standard of ‘substantial further progress’ is still a ways off, participants expect that progress will continue.”

During the three-hour virtual hearing, Powell was peppered with questions from both Republicans and Democrats on rising prices and asked to explain how it would know when it had reached the threshold to taper bond buying.

“It’s very difficult to be precise about it,” Powell said of the goal of substantial further progress. “We will provide lots of notice as we go forward on that.”

The Fed chair will face more questions from the Senate banking panel on Thursday.

Taper Timing

Powell “is trying to push back on this idea on that they are under pressure to exit or that they have decided to taper soon,” said Priya Misra, head of global rates strategy at TD Securities in New York. “He said the labor market has a long way to go.”

U.S. central bankers are providing aggressive support by holding interest rates near zero and buying USUS$120 billion of bonds a month, even as the economy shows strong growth. Job gains have been solid and inflation has jumped, though officials say that’s due to temporary supply glitches as the economy reopens from the pandemic.

Ten-year Treasuries yields edged lower to around 1.35 per cent as Powell testified and U.S. stocks fluctuated near all-time highs.

Critics say that ultra-easy monetary policy alongside massive government spending is overheating the economy. Stephen Stanley, chief economist at Amherst Pierpont Securities in New York, said the Fed policy committee is “in the middle of making a serious policy error.”

“The inflation crescendo is building everywhere except within” the Federal Open Market Committee, the Fed panel that sets interest rates, he wrote in a note to clients. “Companies across virtually all sectors of the economy are seeing sharp input cost increases and are passing them along with far more success than they have seen in decades.”

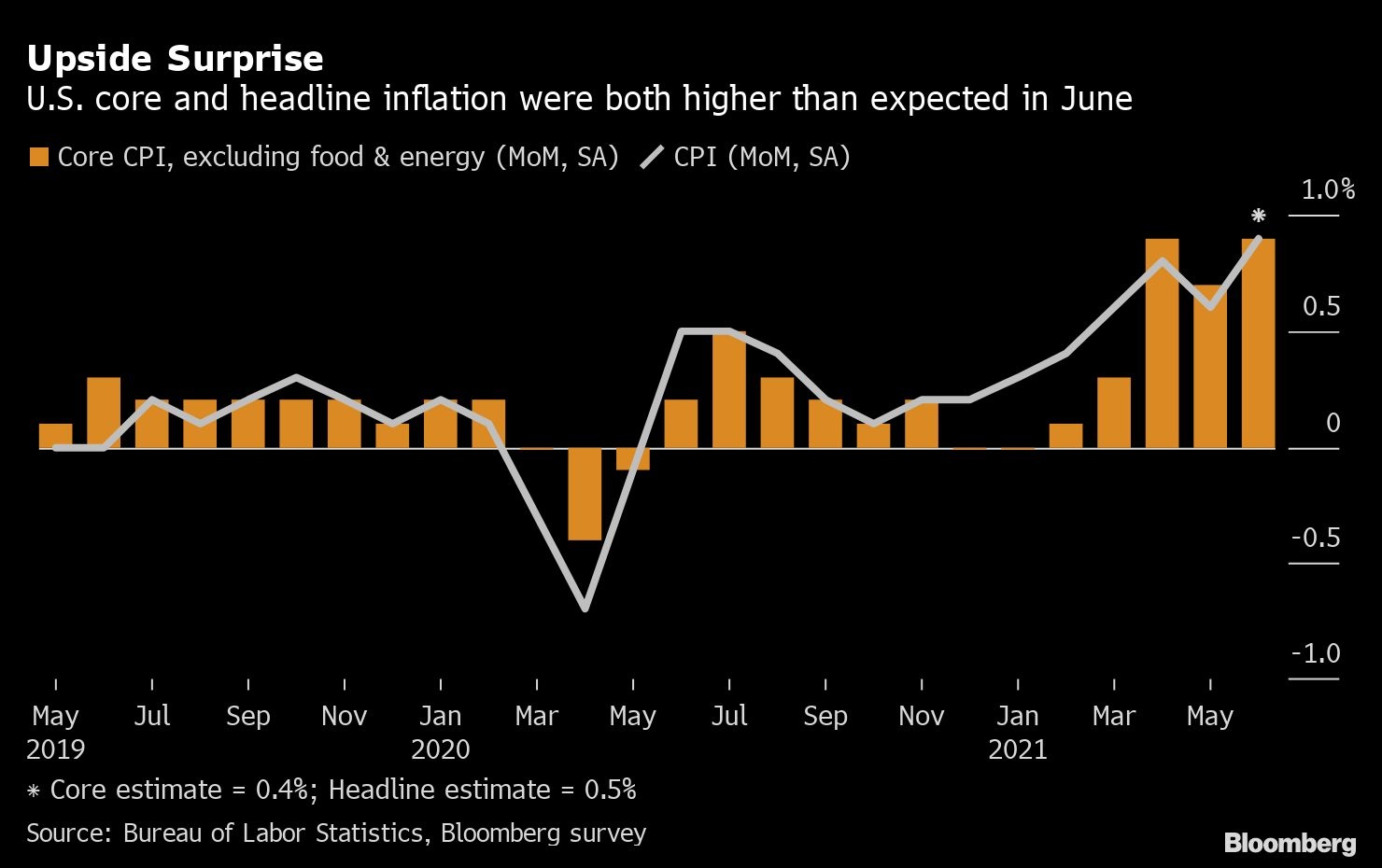

Government data released on Tuesday showed prices paid by U.S. consumers surged in June by the most since 2008 and were up 5.4 per cent from the same month last year.

‘Strong Demand’

“Strong demand in sectors where production bottlenecks or other supply constraints have limited production has led to especially rapid price increases for some goods and services, which should partially reverse as the effects of the bottlenecks unwind,” Powell said. “Prices for services that were hard hit by the pandemic have also jumped in recent months as demand for these services has surged with the reopening of the economy.”

Powell noted that asset prices and risk appetite have risen while downplaying any near-term risks to the economy from financial markets.

“Household balance sheets are, on average, quite strong, business leverage has been declining from high levels, and the institutions at the core of the financial system remain resilient,” he said.

Powell’s remarks before Congress this week are his last semi-annual testimony before President Joe Biden decides whether to give him another four years at the Fed helm or pick someone else. Powell’s tenure as chair expires in February.

The Fed’s policy patience is part of a new framework it announced nearly a year ago that pledged to achieve an average of 2 per cent inflation over time and not pre-judge the level of maximum employment. Fed officials in June started a conversation about when to begin scaling back their asset purchases.

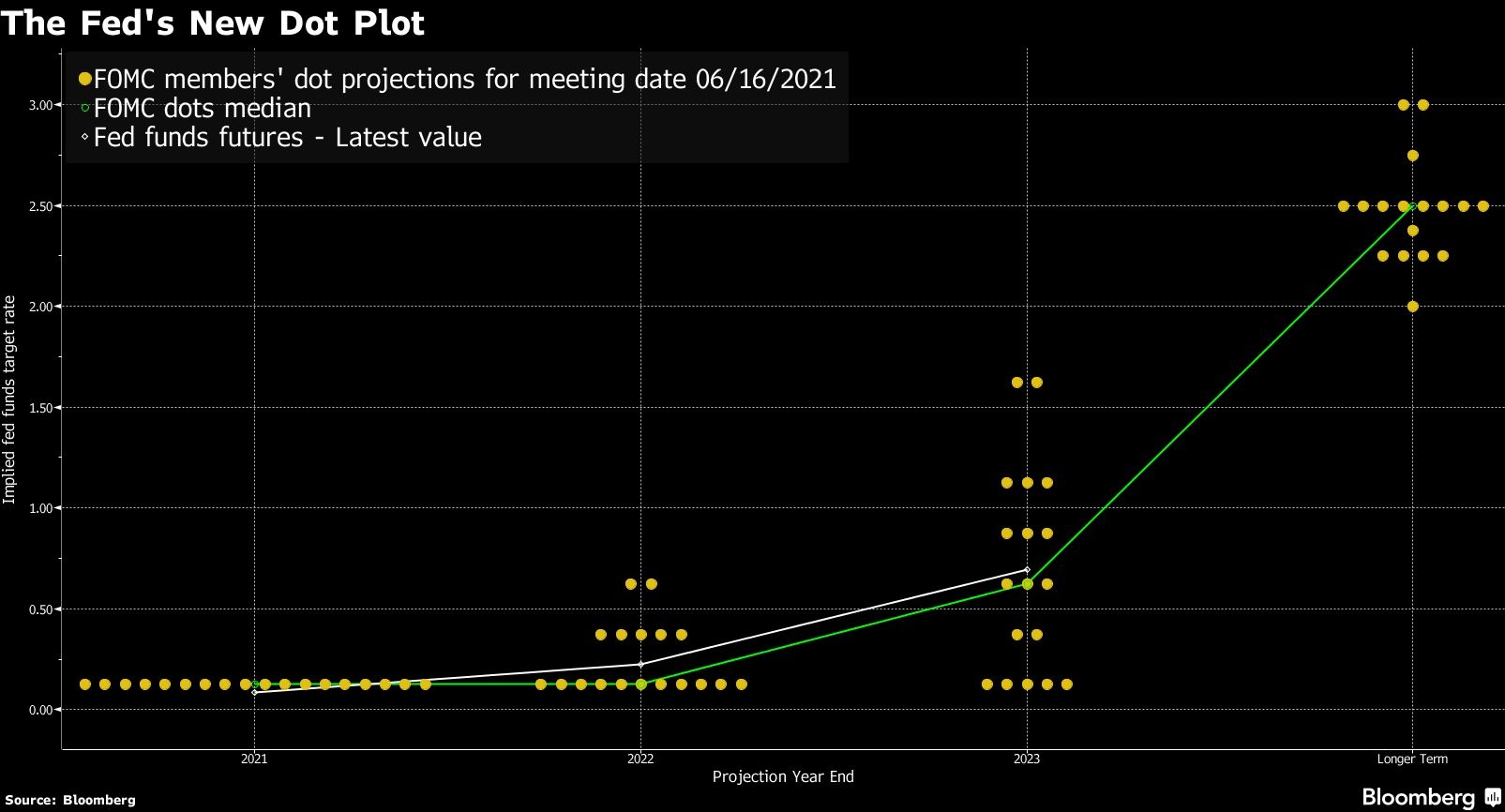

Forecasts released by Fed officials last month also showed them pulling the timing of interest rate liftoff forward, with two increases penciled in for 2023, a move that pushed some market measures of inflation expectations lower.

“Measures of longer-term inflation expectations have moved up from their pandemic lows and are in a range that is broadly consistent with the FOMC’s longer-run inflation goal,” Powell said in his opening remarks.

Both Republicans and Democrats quizzed him about high prices and the Fed’s assessment that these increases would not be persistent.

Powell said recent readings on inflation had been “higher than expected and hoped for,” but stressed the largest gains stemmed from a small group of goods and services.

On the other hand, if high inflation persisted and was threatening to uproot inflation expectations, “we would absolutely change our policy as appropriate,” he said.

Fed officials last month signaled their view of risk and uncertainty around inflation had risen, according to their forecasts.

Labor Market

Powell emphasized in his prepared remarks that the labor market recovery was still far from complete.

“Conditions in the labor market have continued to improve, but there is still a long way to go,” Powell said. “Job gains should be strong in coming months as public health conditions continue to improve and as some of the other pandemic-related factors currently weighing them down diminish.”

He added that despite “substantial improvements” for racial and ethnic groups, “the hardest-hit groups still have the most ground left to regain.”

The U.S. economy added 850,000 jobs in June, the biggest monthly increase since August. Still, broader measures of labor-market slack indicate it is still short of the Fed’s mandate of maximum employment. The jobless rate for Black workers stood at 9.2 per cent compared to 6 per cent in February 2020.