Mar 5, 2023

Powell Set to Lay Groundwork for Higher Rates on Capitol Hill

, Bloomberg News

(Bloomberg) -- Federal Reserve Chair Jerome Powell is expected to echo fellow central bankers in suggesting interest rates will go higher than policymakers anticipated just weeks ago if economic data continue to come in hot.

Powell heads to Capitol Hill this week as Fed officials eye raising rates several more times to quell stubborn inflation — a message that’s making Democratic lawmakers uneasy.

Some policymakers are suggesting they may have to do more to tame prices following a series of strong reports on jobs, prices and consumption, which have spurred traders to bet the Fed will hike beyond the 5.1% level officials estimated in December.

“I want to be completely clear: There is a case to be made that we need to go higher,” Atlanta Fed President Raphael Bostic told reporters Thursday. “Jobs have come in stronger than we expected. Inflation is remaining stubborn at elevated levels. Consumer spending is strong. Labor markets remain quite tight.”

A hawkish tone from Powell, who will testify before a Senate panel on Tuesday and a House committee Wednesday, will likely prompt pushback from progressives warning the Fed not to inflict undue pain on the labor market. That’s been a bright spot for President Joe Biden as he prepares for a tough re-election fight in 2024 and Democrats try to defend a thin Senate majority.

Republican lawmakers, meantime, may cheer the Fed’s actions because they keep the focus on the persistent inflation that’s kept Biden’s approval ratings low. The GOP won control of the House in November’s midterm elections, though also with a slim majority.

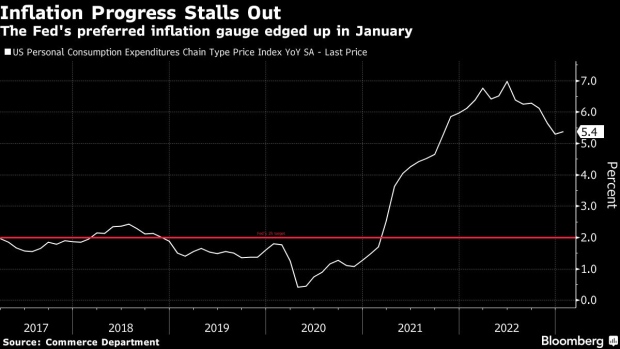

Inflation Goal

Fed officials argue that to sustain labor-market strength over the longer term, they need to get inflation back to the central bank’s 2% target from the current 5.4% pace.

“He’s got to come in hawkish and land with a hawkish message,” Diane Swonk, chief economist at KPMG, said of Powell’s testimony this week. “The bottom line is we’re still at a position where the Fed is not going to allow inflation to become unmoored.”

Powell’s semiannual two-day testimony will be closely watched because it will probably be his last public remarks before the Federal Open Market Committee next meets March 21-22.

The Fed chief said last month that officials anticipated they would need to raise rates further, given the “extraordinarily strong” labor market.

If the job situation remains very hot, “it may well be the case that we have to do more,” he told David Rubenstein during a Feb. 7 question-and-answer session at the Economic Club of Washington.

While the majority of policymakers are signaling that the central bank should continue raising rates in more measured 25 basis-point increments, some officials and Fed watchers have suggested a 50 basis-point move should be on the table if inflation fails to slow.

“It’s clear there is more work to do,” San Francisco Fed President Mary Daly told an audience Saturday at Princeton University in New Jersey. “In order to put this episode of high inflation behind us, further policy tightening, maintained for a longer time, will likely be necessary.”

US central bankers have rapidly raised interest rates to a target range of 4.5% to 4.75% in February, starting from near-zero levels a year ago. Officials stepped down to a 25 basis-point increase last month after a half-point move in December and four jumbo 75 basis-point rate increases last year.

But Fed officials have made clear they have more work to do, after a string of reports in recent weeks pointed to a potential re-acceleration in the economy. The US Labor Department said employers added 517,000 jobs in January, topping expectations, and inflation data and retail sales figures have remained strong.

Half Point

Former Treasury Secretary Lawrence Summers, a staunch critic of the central bank’s inflation response, said Fed officials should emphasize that a return to bigger rate hikes is possible this month in the wake of the stronger economic data.

“The Fed right now should have the door wide open to a 50 basis-point move in March,” Summers said on Bloomberg Television.

Investors are fully pricing in a 25 basis-point rate increase this month, with a 25% chance that the central bank lifts rates by 50 basis points, according the pricing of futures contracts.

Stronger data has also prompted investors to raise their forecast for how high the central bank will raise rates this year, to 5.4%, and to pull back expectations for a rate cut in 2023. That puts market pricing more in line with what Fed officials suggest they will need to do to get inflation under control.

As of December, Fed officials saw interest rates rising to 5.1% by year end, according to median projections issued at that meeting. Fed watchers want to know if officials will raise those forecasts when they pencil in new projections this month.

Pivotal Data

Policymakers will have a few more pivotal reports on hand to help shape those projections, including the February jobs report and a fresh reading on consumer prices.

If payroll and inflation data cool after January’s hot prints, then Fed Governor Christopher Waller indicated he would support raising the central bank’s target rate “a couple more times” to between 5.1% and 5.4%.

But “if those data reports continue to come in too hot, the policy target range will have to be raised this year even more to ensure that we do not lose the momentum that was in place before the data for January were released,” Waller said Thursday in remarks prepared for a virtual event.

The economy’s resilience to aggressive Fed rate hikes could work in Powell’s favor when he testifies this week, Swonk said. “We’ve yet to hit the hardest mile on monetary policy,” she added.

Still, more Democrats are likely to take up Senator Elizabeth Warren’s message that Powell is risking the best labor market in five decades by pushing rates ever higher.

“There is more and more concern” about what rate hikes mean for the labor market “as they head into another election cycle,” said Ian Katz, financial policy analyst at Capital Alpha Partners in Washington. “There is concern that the Fed could do too much.”

--With assistance from Catarina Saraiva and Craig Torres.

©2023 Bloomberg L.P.