Feb 26, 2019

Powell tells U.S. senators the Fed is finding more labour market slack

, Bloomberg News

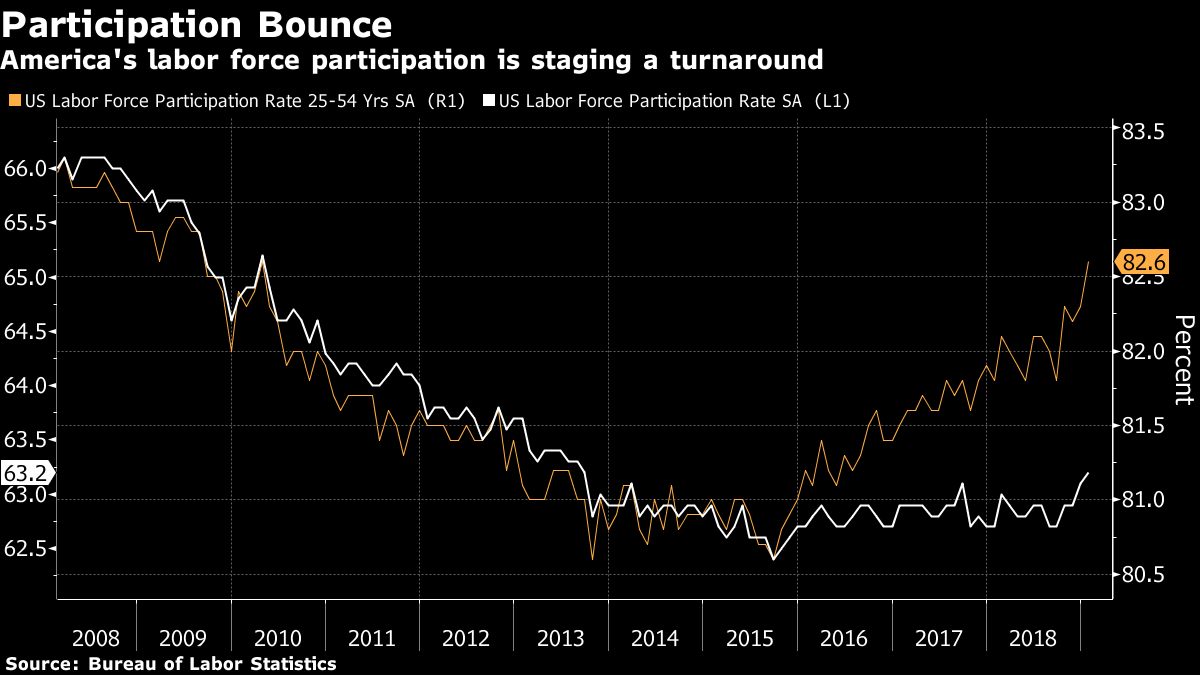

Federal Reserve Chair Jerome Powell said the U.S. labour market still has room to pull in workers. That space for improvement could be a factor bolstering the central bank’s case for patience on future interest-rate increases.

“We have learned this year that there’s more slack in the labour market, because people are coming back in” or staying in, Powell said Tuesday during a Senate Banking Committee hearing. Pointing toward a recent move higher in labour force participation, the share of people working or looking for jobs, he said “that tells us that there is more room to grow, and that certainly has implications for monetary policy.”

Powell noted that the unemployment rate would be lower if the share of people working or looking hadn’t ticked higher. The Fed chief also pointed out that while labour force participation is improving thanks to a strong economy, it remains depressed relative to other advanced economies.

“Our ability to address this is really just a function of trying to keep us at maximum employment,” Powell said, suggesting that factors like benefit payments that discourage work, the opioid crisis, and education and skill gaps could all be factors holding participation rates back.

Powell also said the Fed is paying attention to urban-rural disparities as they try to gauge full employment -- half of the dual mandate given to the Fed by Congress. The central bank is supposed to maintain stable inflation and maximum sustainable employment.

“There’s no one number that you look at, you have to look at a range of indicators, and that would be one of them," he said.

The Fed last month pivoted to leaving rates on hold and Powell repeated that this current moment was a good time to show patience as officials wait to see how headwinds to growth -- including risks emanating from abroad -- play out. Officials have said that slow inflation despite very-low unemployment, and a limited pass-through between wage gains and price increases, are factors helping them maintain that cautious stance.