May 12, 2016

Power Financial's quarterly profit slashed by more than half on investment writedown

The Canadian Press

MONTREAL -- Power Financial Corp. saw its first-quarter profit cut by more than half, largely because of a writedown of one of its investments combined with weaker operating earnings from its two main subsidiaries -- Great-West Life and IGM Financial.

The Montreal-based company (PWF.TO) says its net income dropped to $259 million or 36 cents per share from $573 million or 80 cents per share.

Power Financial is the main subsidiary within Power Corporation of Canada (POW.TO), which primarily owns life insurance and wealth management companies with smaller investments in media including Montreal's La Presse and other industries.

Power Financial's quarter included a $217-million non-operating charge from an indirect investment in LafargeHolcim, a multinational construction materials company based in Europe. That was partly offset by a $101-million gain from the partial sale of an investment in Total SA, the French oil and gas giant.

Operating earnings also fell, to $476 million or 67 cents per share from $565 million or 79 cents per share.

The company's two Winnipeg-based financial subsidiaries -- Great-West Lifeco and IGM Financial -- each saw their operating earnings fall by a total of $73 million while corporate expenses rose by $28 million.

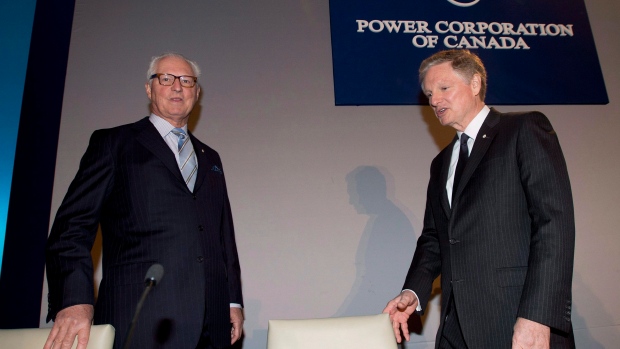

The results were issued before Power Financial's annual shareholders meeting in Montreal.

Power Financial's parent company holds an investment in The Canadian Press as part of a joint agreement with a subsidiary of the Globe and Mail and TorStar Corp.