Jul 25, 2022

Pre-Fed Jitters Send Bitcoin Back Into Sub-$22,000 Trading Range

, Bloomberg News

(Bloomberg) -- Bitcoin sank back into the doldrums of a one-month-old trading range between $19,000 and $22,000, part of a wider cryptocurrency selloff.

The largest digital token fell as much as 4.3% on Monday and was exchanging hands at $21,820 as of 12:15 p.m. in Singapore. Second-ranked Ether and smaller virtual coins like Avalanche and Solana nursed larger declines.

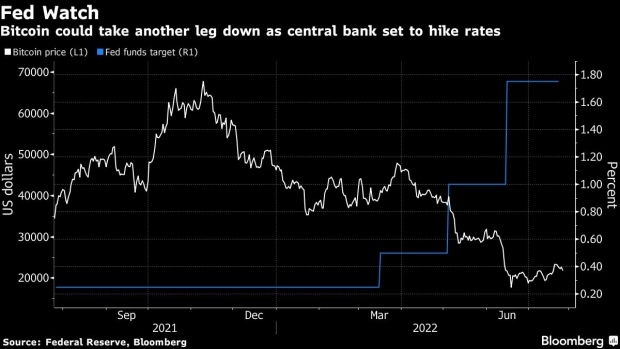

Crypto may again be at the vanguard of swings in riskier investments ahead of an expected Federal Reserve interest-rate hike on Wednesday and a slate of earnings from megacap technology firms in the US amid a slowing economy.

The past two rate increases by the US central bank ended up sapping market sentiment. Poor earnings could also drag down tech shares and Bitcoin given the correlation between the two. That said, some prognosticators continue to believe the worst of Bitcoin’s selloff is over after a 53% plunge this year.

“If crypto investors can stomach this week’s likely Fed-induced volatility, it should transpire that Wednesday’s rise” past $24,000 “wasn’t a flash in the pan,” said Antoni Trenchev, co-founder at crypto lender Nexo.

The digital-asset sector has begun to clean up the wreckage of a leveraged speculative binge that found its comeuppance in a Fed determined to tighten monetary settings to slay runaway inflation.

While any hints of crypto stabilization are still very tentative, they are enough for some market watchers to look up rather than down.

Nexo’s Trenchev and Rick Bensignor of Bensignor Investment Strategies flagged the $30,000 level, suggesting that’s where Bitcoin could head to before meeting some technical resistance.

©2022 Bloomberg L.P.