Dec 12, 2018

`Premature' Turkey Rate Cut Haunts Market After Belated Hike

, Bloomberg News

(Bloomberg) -- President Recep Tayyip Erdogan’s silence on interest rates is doing little to soothe market worry that Turkey’s central bank could act too soon to loosen policy.

Long known for his unorthodox view that rate hikes only lead to faster price gains, Erdogan has mostly kept mum since warning after an emergency increase in September that “there is a limit” to his patience. But the combination of a sharp economic slowdown last quarter and the strain of corporate debt is fueling bets for monetary easing before local elections in March.

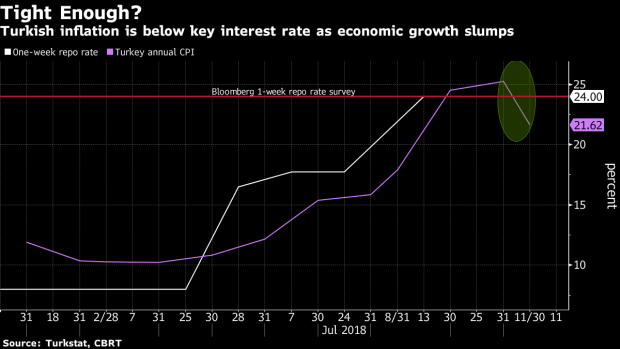

For its part, the central bank has vowed to maintain a tight stance for a long time, with inflation on track to end the year at more than quadruple its official target of 5 percent. All 24 analysts surveyed by Bloomberg predict policy makers will keep their benchmark at 24 percent on Thursday for a second straight meeting.

“The key question is not if the central bank will cut, but rather when,” Carla Slim, an economist for Standard Chartered Plc in Dubai, said in an emailed report. “However, a premature cut, or investor perceptions that it may be easing prematurely, could be negative for markets.”

The central bank watched in August as the lira buckled, before pulling off a dramatic rate hike of 625 basis points the following month. But now that the Turkish currency has gained over 18 percent against the dollar in the past three months, the world’s biggest rally in that period, the darkening outlook for the economy could increasingly sway monetary policy, especially after inflation slowed more than forecast in November.

For now, only one economist in a separate Bloomberg poll predicts a cut in the second quarter of next year, with rates seen on hold until then.

Despite the encouraging price slowdown, there’s a risk that borrowing costs could be lowered too quickly to support the economy, while inflation may ultimately accelerate again once growth stabilizes, according to Commerzbank AG analyst Tatha Ghose.

“This would re-ignite lira depreciation,” Ghose said in a research note. “The government is of course likely to loosen its fiscal strings noticeably; but besides this, pressure is likely to increase on the central bank to lower interest rates.”

Data on Monday showed gross domestic product shrank last quarter from the previous three months, while missing forecasts with the slowest annual expansion since 2016. An ill-timed rate cut could only make Turkey’s predicament worse.

“We see the central bank remaining on hold in the coming months,” Yarkin Cebeci, an economist at JPMorgan Chase & Co., said in a note to clients. “The main risk is that of premature easing, which could dent investor sentiment and stop the capital inflows needed to finance any sustained recovery in economic activity.”

(Updates with lira’s performance in fifth paragraph.)

--With assistance from Harumi Ichikura.

To contact the reporter on this story: Cagan Koc in Istanbul at ckoc2@bloomberg.net

To contact the editors responsible for this story: Shaji Mathew at shajimathew@bloomberg.net, Paul Abelsky, Onur Ant

©2018 Bloomberg L.P.