Feb 20, 2020

Private Equity Bet on German Drugmaker Goes South Quickly

, Bloomberg News

(Bloomberg) -- A hefty bet on a German cancer drug maker is proving a major headache for Swedish investment firm EQT, one of a slew of companies seeking to capitalize on Europe’s fast-growing direct lending sector.

Less than six months after EQT AB’s private credit division arranged a 331 million euro ($357 million) loan for Alanta Health Group GmbH in the summer of 2019, police officers searched dozens of the company’s premises. An investigation is now underway into how its subsidiary ZytoService Deutschland wins business from the doctors prescribing its drugs. The pharmaceutical company accounts for almost three-quarters of Alanta’s revenues according to 2018 figures.

With up to 10% of EQT’s 2.3 billion euro pooled fund involved in the financing, the fallout could prove seriously damaging, and comes just as the investment firm mulls selling off its credit arm. Questions hanging over the firm’s largest borrower may not help attract a new owner.

EQT declined to comment for this article. A spokeswoman for Alanta said that she could not comment on an ongoing investigation. In a previous statement the company rejected any allegations of wrongdoing and stated that its top priority is to provide high-quality patient care.

“Typically investors would not want to see positions of over 5%,” Trevor Castledine, a London-based senior director with bfinance, which advises institutional investors on how best to invest capital, said. “To the extent that fund documents allow more than that, investors would expect that to be very much the exception.”

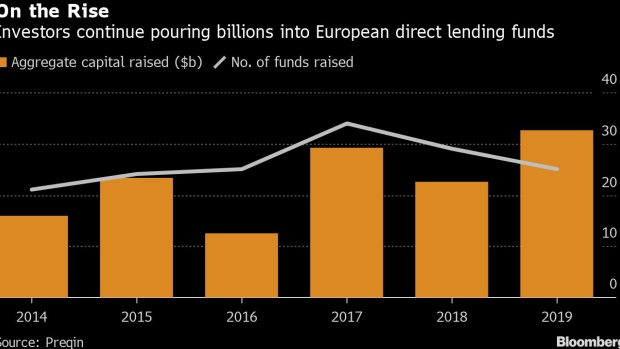

Private equity shops have moved in to fill the vacuum left by banks retreating from riskier lending in the wake of the financial crisis. Negative interest rates and the European Central Bank’s bond-buying program have squeezed lenders’ room for maneuver, pushing them into alternative investments like direct lending, which offer greater rewards in return for greater risks.

Big Bet

EQT’s refinancing of Alanta, which is controlled by IK Investment Partners Ltd, was the largest debt transaction so far for its direct lending arm.

The deal was so large, it was too big to sit as a single exposure in the firm’s fund, so EQT invited its investors to take additional chunks of the debt, according to people familiar with the transaction, potentially meaning they could be on the hook twice-over.

A spokeswoman for Hamburg’s general prosecutor said that the inquiry will take months as they investigate 14 people, including pharmacists, doctors and high-ranking company officials whom they allege may have caused financial damages of at least 8.6 million euros.

German police received the first anonymous complaint in the case against ZytoService on Sept. 8 2017, the prosecutors said, but only started questioning suspects after the raids in December last year.

For now, ZytoService continues operations and performance is good, according to people familiar with the business. There’s no actual loss for either the equity or debt investors to book.

Refinancing Deal

ZytoService was bought in 2016 by IK Investment Partners, a private equity firm born out of the Wallenburg family’s businesses. As IK added medical centers, it created a new parent company -- Alanta -- to hold them all.

When EQT refinanced the company last summer, bank lenders Hamburg Commercial Bank and SEB were also involved, providing a 15 million euro revolving credit facility and taking the most senior ‘first out’ slice of the term loans.

EQT’s sell-down of the loan to first banks, and latterly its own investors is fairly common practice within Europe’s fast growing direct lending sector.

Spokespeople for HCOB, SEB and IK Investment Partners declined to comment.

--With assistance from Jan-Henrik Förster and Benjamin Robertson.

To contact the reporters on this story: Rachel McGovern in Dublin at rmcgovern17@bloomberg.net;Fabian Graber in London at fgraber2@bloomberg.net

To contact the editors responsible for this story: Vivianne Rodrigues at vrodrigues3@bloomberg.net, Bruce Douglas

©2020 Bloomberg L.P.