Jul 16, 2019

Private Student Loan Debt Growing for College Students

, Bloomberg News

(Bloomberg) -- In the pecking order of meeting college costs, consumers usually don’t turn to private student loan markets until they have exhausted all other means. And for good reason -- private loans are generally more expensive and more difficult to obtain.

While the private student loan debt market is just a sliver of the $1.6 trillion in outstanding student loans, it has grown to more than $100 billion with 1.4 million borrowers, according to a report by LendEdu.

Federal student loans, funded by the U.S. Department of Education, don’t require a credit check, proof of income, or a co-signer. The loans typically charge a lower interest rate than what private lenders offer.

Private student loans are offered by private lenders seeking a profit. Typically, interest rates are higher and a good credit score is needed to qualify. Private loans are by no means guaranteed. Only about a third of loans were approved with a co-signer this year, based on a Lendedu database of about 200,000 private student loan applicants. Fewer than one-in-10 applicants were approved without a co-signer.

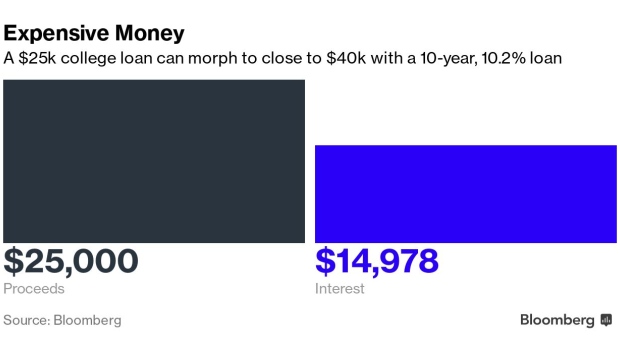

The average interest charged by a private lender in both 2018 and 2019 was 10.2% -- about double the average prime rate during that time. Over a 10-year loan, this effectively turns a $25,000 tuition bill to $40,000.

Key Insights

- From 2016 to 2019, the approval rate for private student loans was 21%.

- For co-signed private loans, the approval rate was 40.5%, while the approval rate for not co-signed private student loans was 8.7%

- From 2016 to 2019, the average approved private student loan amount was $13,780

- There is a large divergence between credit scores for the average applicant and the average for approved loans

- From 2016 to 2019, the average applicant FICO credit score for private student loans was 644, while the average approved FICO credit score was 737

- The average applicant income for private student loans was $44,583, while the average approved income was $72,947

To contact the reporter on this story: Alex Tanzi in Washington at atanzi@bloomberg.net

To contact the editors responsible for this story: Alex Tanzi at atanzi@bloomberg.net, Chris Middleton

©2019 Bloomberg L.P.