May 22, 2020

Profits From Making Fuels Are Trailing Far Behind Oil’s Recovery

, Bloomberg News

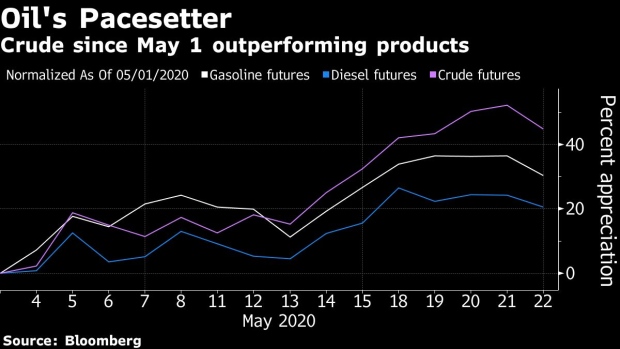

(Bloomberg) -- Returns from turning oil into fuels are lagging behind crude’s jump, signaling that prices are still vulnerable and demand may not be recovering fast enough to justify the rally.

Crude futures have soared 73% in May, rebounding from their historic crash below zero just over a month ago, helped by production cuts across the globe after the coronavirus crisis crushed demand. Prices have also been helped by optimism that easing pandemic-related lockdowns will lead to a recovery in consumption. However, refined products haven’t been able to ride that wave.

Evidence can be found in the spread between U.S. benchmark West Texas Intermediate oil and combination gasoline-diesel output, or the so-called 3-2-1 refining margin. That hasn’t closed above $11 a barrel since May 12, and is languishing over $1 below its 50-day average, data compiled by Bloomberg show.

“Crude outrights and differentials have advanced on the back of swift curtailments, but products have been unable to keep up with the advance,” said Stephen Wolfe, an analyst at industry consultant Energy Aspects. “End-user demand has not recovered quickly enough” and fuel stockpiles are still high, he said.

“The crude rally remains vulnerable to weakening margins unless stored products and end-user demand can support more quickly,” Wolfe said.

Also read:

©2020 Bloomberg L.P.