(Bloomberg) -- With arguably the most room for interest-rate cuts in Asia, and a fresh political mandate for its pro-business president, Indonesia would appear to offer much for stock investors. Instead, the market has been a laggard, and may be at risk of staying that way.

For one thing, President Joko Widodo, known as Jokowi, took office in 2014 targeting 7% economic growth, but his Southeast Asian nation hasn’t even managed a 6% pace since then. The central bank last week confirmed its expectation for growth to miss 5.2% this year. And for all the potential of an expanding middle class in the world’s fourth most-populous nation, Indonesia’s consumer-facing companies are currently caught in a slowdown.

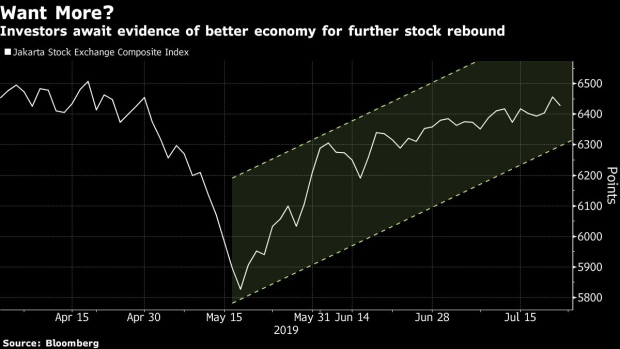

Such lackluster performance helps explain why the Jakarta Composite Index has only risen 3.8% this year, well behind the 9.1% gain for the MSCI Asia Pacific Index. That’s despite Bank Indonesia lowering interest rates for the first time in almost two years. Its benchmark remains one of the highest in the world, at 5.75%.

“Investors will start pricing in both a GDP growth slowdown as well as an earnings-growth slowdown,” said Harry Su, head of equity capital markets at Samuel International, an investment and research firm. “The direction of the JCI will be determined by politics, such as the upcoming cabinet formation,” he said, referring to the Jakarta Composite Index.

Jokowi is expected to announce his cabinet lineup before starting his second term in October. Earlier this month, he vowed to implement a wave of reforms to attract foreign investment, including cutting corporate taxes, overhauling labor laws and lifting curbs on foreign ownership in more industries.

With the Federal Reserve poised to lower rates, Indonesia has the space to unwind the tightening it was effectively forced into by U.S. rate hikes -- which had sent the rupiah tumbling against the dollar. Bank Indonesia Governor Perry Warjiyo highlighted Monday that there’s still room for easing. And a sovereign-rating upgrade by S&P Global Ratings from May could also help shrink financing costs.

The “normalizing” of monetary policy means Indonesia is at an attractive starting point, said Michiel van Voorst, chief investment officer for Asian equities at UBP Asset Management Asia Ltd.

In the meantime, investors are contending with some challenging numbers. Second-quarter gross domestic product figures are due Aug. 5. Several indicators have showed slowing sales in the April-to-June period. This year’s unusually long Eid al-Fitr holidays contributed to the sluggishness.

In retail sector, PT Ace Hardware Indonesia and PT Ramayana Lestari Sentosa just reported same-store sales growth in June that was lower than expected. Major car maker PT Astra International reported a 1% decline in its June sales compared with a year ago.

“Ultimately it comes down to growth metrics and when markets start to look under the hood, it’s usually the weaker links in the chain that fall first,” said Stephen Innes, a managing partner at Vanguard Markets Pte.

To contact the reporters on this story: Tassia Sipahutar in Jakarta at ssipahutar@bloomberg.net;Abhishek Vishnoi in Singapore at avishnoi4@bloomberg.net;Moxy Ying in Hong Kong at yying13@bloomberg.net

To contact the editors responsible for this story: Lianting Tu at ltu4@bloomberg.net, Christopher Anstey

©2019 Bloomberg L.P.