Jun 27, 2022

Prosus Will Sell Tencent Shares to Bankroll Buyback Program

, Bloomberg News

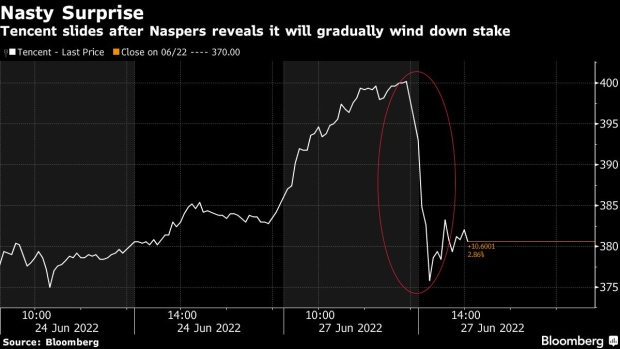

(Bloomberg) -- An arm of South African internet giant Naspers Ltd. plans to sell down its holding in Tencent Holdings Ltd. to finance a share buyback program, sending the Chinese internet firm as much as 2.5% lower.

Tencent erased earlier gains in Hong Kong on Monday as investors pondered the extent to which Naspers, the Chinese company’s biggest shareholder, will unload its stock.

Naspers and its unit Prosus NV, which groups most of the South African’s company’s internet holdings, disclosed the program the same day as they revealed the sale of almost $4 billion of stock in e-commerce giant JD.com Inc. that they got from Tencent as a special dividend.

The twin sales revive concerns around the long-term viability of holding shares in Chinese internet firms, which are only just emerging from more than a year of unprecedented scrutiny from Beijing. Naspers said it will manage the sale of Tencent stock in an orderly fashion, adding that any shares sold would comprise a fraction of the Chinese firm’s average trading volume.

Naspers and Prosus have long been frustrated that the companies’ stake in Tencent is worth more than the businesses as a whole, and the share sale is the latest attempt to reduce the discount. The gap has become “unacceptable,” they said in statements.

Read more: China’s Traumatized Tech Insiders Signal Danger for Market Rally

Naspers aims to “rebalance our asset base towards our fast-growing non-Tencent assets, whose value we expect to increase over time, while retaining exposure to Tencent’s significant value creation potential,” Chief Executive Officer Bob van Dijk said in the statement. “We will continue to execute our long-term strategy to build valuable consumer internet businesses to deliver sustainable returns over the long term.”

Investors are considering whether to pile back into Chinese internet stocks after a selloff that began in 2021, at one point wiping out more than $1 trillion of market value. Some analysts believe Beijing has turned more supportive of the crucial industry, but Nasper’s announcement may temper that somewhat.

Tencent said in a separate statement it supported its shareholders’ decision and expects limited impact on the Chinese social giant itself.

“People are concerned about the upcoming selling pressure on the stock especially after it rebounded to nearly HK$400 recently,” Steven Leung, executive director at UOB Kay Hian, said by phone. “It has clouded the share outlook in the near term for sure.”

Read more: Tencent-Backer Prosus Unloads Nearly $4 Billion of JD.com Stock

(Updates with share action from the first paragraph)

©2022 Bloomberg L.P.