Dec 18, 2022

Putin’s War Makes Russian Stocks World’s Worst With Grim Outlook

, Bloomberg News

(Bloomberg) -- Vladimir Putin’s invasion of Ukraine sent Russian equities tumbling in February. Nearly 10 months later, a recovery looks far off after sanctions triggered an investor exodus and made them the world’s worst performers.

While the economy has largely stood up better than expected to sanctions imposed by the US and its allies, the stock market paints a different picture.

Russian equities have been excluded from global benchmarks and exchange-traded funds tracking the country’s shares have either been frozen or closed. Local investors haven’t been able to save the domestic market from its war-induced slump, even though most foreigners are still banned from selling the local stocks they hold.

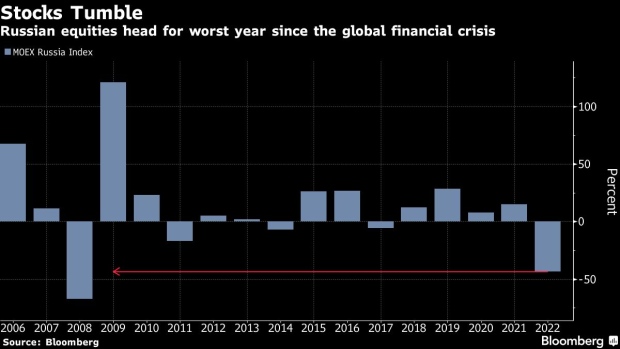

February’s selloff prompted a record-long shutdown of the Moscow market. Its dollar-denominated RTS Index has now sunk 35% this year, making it the worst performing benchmark among 92 tracked globally by Bloomberg in local currency terms and third-worst in dollars. The MOEX Russia Index, priced in rubles, has plummeted 44%, on track for the steepest annual drop since 2008. With the strain of war growing, more losses may lie in store.

“Russian stocks reflect a bleak outlook as Western sanctions are starting to weigh on the domestic economy,” said Piotr Matys, a senior currency analyst at InTouch Capital Markets Ltd. “The prospect of a global downturn over the next few quarters does not bode well for Russian oil, especially at the time when the European Union is fully committed to reducing its reliance on Russian commodities.”

The EU and G-7 have agreed to prohibit companies from the blocs from providing key services including insurance to ships carrying Russian crude if it was purchased above a price cap of $60 a barrel. Russian oil stocks have also been buffeted by volatile crude prices, with benchmark Brent sinking about 40% from its March high.

Lukoil PJSC and Gazprom PJSC, the weightiest members of the MOEX Index, are down 30% and 53% respectively this year. Meanwhile, the largest listed lender, Sberbank of Russia PJSC, has tumbled 54% as international sanctions hit everything from Russia’s ability to access foreign reserves to the SWIFT bank-messaging system.

Concerns that Putin might broaden the call-up of reservists from the 300,000 men mobilized in September has also damped local retail investors’ confidence that they have money to put to work in the stock market.

Can the New Oil Price Cap Starve Russia’s War Effort?: QuickTake

“In a way, I find Russian equity market underperformance surprising as all geopolitical risks have been priced in at the beginning and late sanctions, even the price cap, is not a game changer for Russian equities,” said Iskander Lutsko, chief investment strategist at ITI Capital in Moscow. He attributes the continued slide in the market to “a lack of support from local institutional funds, while retail demand has been weakened by risks of mobilization and deposit outflows.”

Next year is unlikely to bring relief as the war and capital controls continue, especially if a global recession curbs demand for commodities and new sanctions pressure the Russian economy even further. On Thursday, EU member states reached a deal on a ninth package of sanctions on Russia, targeting new banks and officials as well as the country’s access to drones.

“Without fresh capital inflows, constrained by Western sanctions, Russian stocks are likely to underperform again next year,” Matys at InTouch Capital Markets said.

©2022 Bloomberg L.P.