May 21, 2019

QE May Be Over, But the Fed’s U.S. Debt Hoard Is About to Soar

, Bloomberg News

(Bloomberg) -- If you thought the Federal Reserve was done with quantitative easing, you might only be half right.

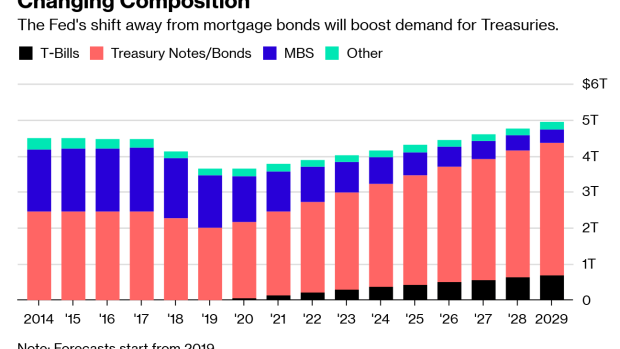

As soon as next year, analysts say the Fed will resume large-scale buying of debt securities -- this time just U.S. Treasuries -- in amounts that may ultimately exceed its crisis-era purchases. According to an estimate by Wells Fargo & Co., the central bank’s balance sheet will rise past its historic peak as it adds over $2 trillion to its Treasury debt holdings in the next decade.

Of course, it won’t be called QE, which President Donald Trump has urged the Fed to restart. Rather than trying to drive down long-term interest rates to boost growth, the purchases are intended to replace the Fed’s mortgage-bond holdings gradually as they mature and to keep ample reserves in the banking system. But the effect, some say, will nevertheless be largely the same.

“For anybody that has been in the market for the last 10 years, it will feel like QE,” said Priya Misra, global head of rates strategy at TD Securities. “Once again the Fed will be the single largest buyer of Treasuries and (this time) in a non-QE world. This will be a very bullish Treasury-market dynamic.”

And what happens in the U.S. Treasury market may have lasting consequences for the broader economy. Not only do Treasury yields reflect how much the government pays to borrow money for an array of federal programs, but as the global benchmark for lending, they also determine the interest rates on everything from mortgages to auto loans and corporate debt. So the more the Fed bought and held through QE, the theory went, the cheaper it would ultimately be for consumers and businesses to take out loans.

During the post-crisis era, yields on 10-year Treasuries have averaged just under 2.5% -- roughly half the level in the decade prior to the financial crisis.

Monetary policy is “a little more stimulative today than it would have been pre-crisis because of these balance-sheet dynamics,” said Jay Bryson, global economist at Wells Fargo. The big takeaway for the average person is that, all else being equal, rates on mortgages and other long-term loans in the broader economy are slightly lower because of the Fed’s large debt holdings.

Granted, a lot of the bang from QE itself came from its “signaling effect,” which drove yields lower as investors anticipated the Fed’s purchases, says Lawrence Dyer, head of U.S. rates strategy at HSBC. Another caveat is the Treasury market has doubled in the past decade, so the impact of the Fed’s balance-sheet buildup isn’t likely to be as large as an actual quantitative-easing program. Relative to the size of the economy, the central bank’s bond investments will continue to be lower than they were during the height of QE.

On Wednesday, the Fed will release the minutes from its last policy meeting, which may provide clues on what it plans to do with its balance sheet.

Before the start of the first round of QE in 2008, the Fed had less than $900 billion in U.S. debt securities. By 2017, it had amassed $2.5 trillion of Treasuries, as well as $1.8 trillion in mortgage-backed securities. The bank finally began unwinding QE in October 2017 in an effort to “normalize” its monetary policy, and will continue winnowing through the end of September.

Chair Jerome Powell has said the Fed was never likely to get the size of its balance sheet -- long a lightning rod for certain politicians and finance types -- back down to pre-crisis levels. But what officials haven’t really detailed is how large it will grow and how much U.S. debt the central bank will gobble up.

The Fed will have around $2 trillion in Treasuries by year-end. By mid-2020 though, most Wall Street dealers expect the bank to start accumulating Treasuries once again, à la QE. And by the end of the coming decade, it will have more than doubled its holdings of the debt to roughly $4.4 trillion, leaving the overall size of its balance sheet close to $5 trillion, a Wells Fargo estimate showed. (Its MBS holdings will shrink from over $1.4 trillion to under $400 billion in that span.)

Next year alone, TD’s Misra expects the Fed will purchase about $300 billion of Treasuries from the open market, or roughly 30% of the over $1 trillion that the U.S. is forecast to issue to cover its ballooning deficit. That’s in addition to the nearly $300 billion of maturing Treasuries the Fed will replace by buying directly from the government.

What the Fed buys matters. Officials have said they may tilt purchases toward shorter maturities. No final plan has been set. The Fed holds no T-bills after swapping them out earlier this decade to drive down longer-term yields. Bill purchases could help lower short-term funding costs and widen the gap between 3-month and 10-year rates -- a key bond-market recession indicator -- after that part of the yield curve sporadically inverted since March, says Margaret Steinbach, a fixed-income investment specialist at Capital Group.

“As part of normalization, we will have to decide what the maturity structure should be in the longer term,” Powell said at a May 1 press conference.

So why exactly is the Fed getting back into the business of buying bonds? Part of it simply has to do with accounting. While attention has been focused on the asset side of the Fed’s balance sheet, it also has liabilities, which mainly come in the form of currency in circulation and bank reserves. As with any balance sheet, the two sides need to net out. Since those liabilities tend to naturally increase over time with the economy, so too must the Fed’s assets.

It was this balancing act that prompted some on Wall Street to say the QE unwind was creating reserve scarcity. That by shrinking its asset base, the Fed squeezed reserves as currency grew on the liability side of its ledger. Lorie Logan, a key New York Fed official, said in April it’s monitoring indicators for changes in reserve conditions. Once the Fed decides the banking system has an appropriate level of reserves, it will need to start buying Treasuries again.

Morgan Stanley’s Matthew Hornbach, who estimates the Fed will buy about $278 billion of Treasuries from the open market next year, says a third of that will be needed to prevent currency growth from squeezing bank reserves.

Post-crisis regulations to curb financial risk-taking, as well as the fact the Fed pays interest on excess reserves as a policy tool, have also prompted banks to hold far more cash than before. That all suggests the Fed likely will keep growing its asset base -- indefinitely -- by continually buying Treasuries.

And as long as the stock of debt on the balance sheet remains large, some academics suggest it will keep providing stimulus to the economy, regardless of how much buying takes place in any given year.

Developments in short-term funding markets could force the Fed’s hand. This month, the Fed reduced its interest rate on excess reserves, or IOER, to keep its target rate from drifting higher. Some observers say the rise is a knock-on effect of the QE unwind, which has caused demand for short-term cash to rise.

“It really raises questions about how well the Fed truly does understand liquidity conditions and demand for reserves in the banking system,” Mark Cabana, head of U.S. interest rate strategy at Bank of America, said on Bloomberg Television. It increases the chances officials will need “to grow the balance sheet earlier than the Fed has been anticipating.”

To contact the reporters on this story: Liz Capo McCormick in New York at emccormick7@bloomberg.net;Alexandra Harris in New York at aharris48@bloomberg.net

To contact the editors responsible for this story: Benjamin Purvis at bpurvis@bloomberg.net, Michael Tsang, Larry Reibstein

©2019 Bloomberg L.P.