Jun 18, 2020

Quadruple witching hits stock market, sparking bursts of trading

, Bloomberg News

This market is due for a pause: Trader

Traders struggling to keep up with gyrations in U.S. stocks just got jolted by a surge of trading volume.

Transactions in stocks spiked amid a quarterly event known as quadruple witching, when options and futures on indexes and equities expire. During the first 15 minutes of trading, volume on the S&P 500 was about 70 per cent higher than the average for that time of day over the past 30 sessions.

Quadruple witching usually coincides with a rebalancing of major indexes such as the S&P 500 and can spark some of the busiest trading days of the year. While the global market turmoil in March prompted S&P Dow Jones Indices to postpone the last rebalancing, the quadruple witching alone was enough to trigger a volume surge.

This time, the need to adjust stock positions appears to be higher than usual. About US$1.8 trillion of S&P 500 options are scheduled to expire, making it the third-largest non-December expiration on record, data compiled by Goldman Sachs Group Inc. showed. The index rebalancing could force US$48 billion of trades, up from US$30 billion six months ago, S&P Dow Jones estimated. While spikes in volume usually occur around the open and close, providing windows of robust liquidity, large price swings can happen suddenly at any time of the day.

“Investors need to be prepared,” said Chris Gaffney, president of world markets at TIAA Bank. “When we see the run-up like we’ve seen and you have investors trying to protect their portfolios, protect the gains and having the uncertainty still out there, you’ve got some big options positions in the markets right now and the decisions to roll them or not on that day is what drives the volatility.”

The S&P 500 rose 1 per cent as of 9:45 a.m. in New York, extending its weekly gain to 3.4 per cent.

After a relentless run that drove the S&P 500’s gain from its March trough to over 40 per cent, the market has settled in a new range where traders have been whipsawed by hopes for a sharp economic recovery and fears over a second wave of coronavirus infections. Stocks last week posted their worst decline since the depths of the bear market. That looked set to continue Monday when shares tumbled 2.5 per cent, but the S&P 500 staged a rebound to close higher by 0.8 per cent.

The turbulence came with higher trading volume. Halfway into June, more than 13 billion shares have changed hands each day on average, on course for the second-busiest month since at least 2008.

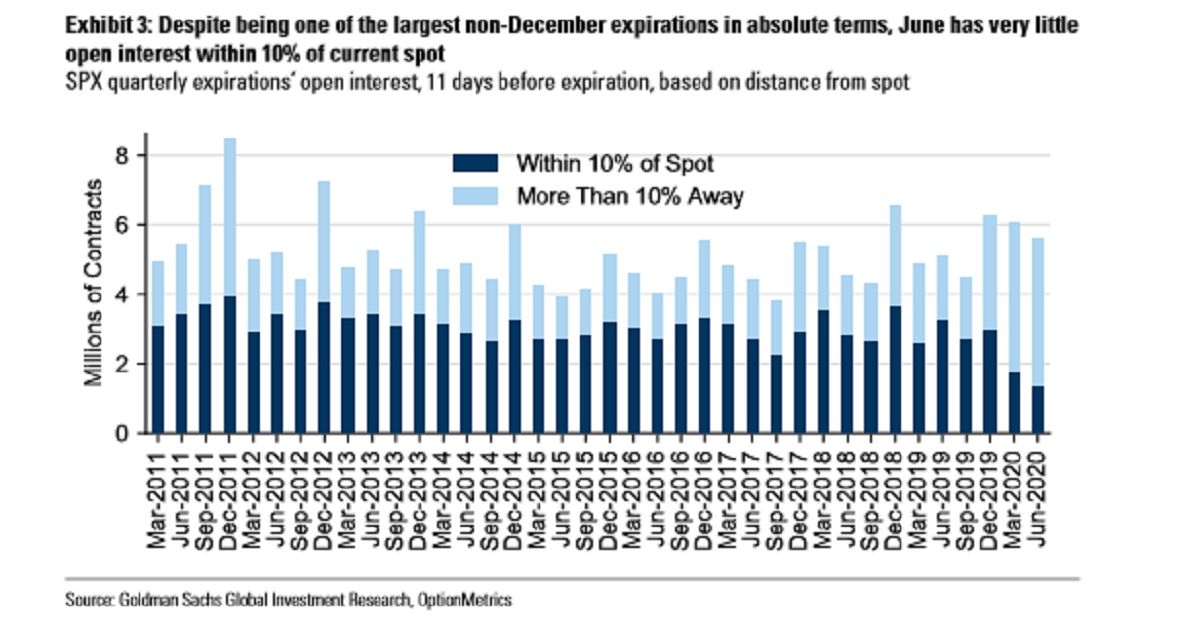

While trading activity rose Friday, the impact of quadruple witching on the market’s overall direction is difficult to predict. Take S&P 500 options for instance. Despite an elevated level in open interest, Goldman Sachs found that fewer than 2 million expiring contracts are within 10 per cent of where the underlying index trades. That’s the smallest amount in at least a decade and underscores how the velocity of the rebound left many hedges useless.

That led to what strategists including Rocky Fishman called a “light” gamma. Put another way, the value of options contracts with high sensitivity to the S&P 500’s move is very low, making the expiration less likely to drive the index’s move on Friday. Estimated at US$80 billion, the gross gamma of S&P 500 options sat at the 4th percentile of its three-year range.

“Despite a very large number of contracts expiring, many of these were hedges bought during March and April and are now significantly away from the index price,” said David Silber, head of institutional equity derivatives at Citadel Securities. “As a result of such a large percentage of the open interest being significantly out of the money, this expiration could be a significantly smaller catalyst and event for the market.”

Another way to look at the event is through the lens of options dealers, who typically need to hedge their positions by buying or selling underlying stocks. Their holdings are often scrutinized to gauge the potential impact, with “long gamma” indicating they’re pushing against the prevailing trend while “short gamma” points to a tendency to go with the trend.

To Charlie McElligott, a cross-asset strategist at Nomura Securities, the fact that the S&P 500 has been hovering around the 3,100-3,150 level in recent days suggested that the overall dealer profile remains “moderately long- to neutral-Gamma.” After the event, the gamma-related equity exposure could shrink by nearly 42 per cent, he estimated.

If history is any guide, investors may need to get ready for a market pullback or a wider trading range, McElligott warned. Since 1994, the options expiration in June has seen stocks falling 88 per cent of the time over the following week, with the S&P 500 sliding 1.2 per cent on average, the firm’s data showed.

That pattern, along with some deteriorating momentum and breadth indicators, is a recipe for market weakness to Russ Visch, a technical analyst with BMO Capital Markets.

“Between the current technicals and the historical tendencies, the bias appears to be the downside for equities all the way out into next week,” said Visch. “The short-term pullback which began last week is not over yet.”