Nov 3, 2021

Qualcomm Gives Upbeat Forecast on Surging Demand for Phone Chips

, Bloomberg News

(Bloomberg) -- Qualcomm Inc., the world’s largest smartphone chipmaker, gave a stronger-than-expected outlook for the current quarter, lifted by surging demand for 5G devices and the company’s push into new markets.

Earnings will be $2.90 to $3.10 a share in the period ending in December, the company said Wednesday, triggering a stock rally in late trading. Revenue will be $10 billion to $10.8 billion. Wall Street had projected profit of $2.58 a share and sales of $9.73 billion, according to data compiled by Bloomberg.

The growth suggests Qualcomm is navigating a supply chain crunch that has roiled much of the tech industry. Chief Executive Officer Cristiano Amon said he has diversified Qualcomm’s suppliers to ensure the company can get what it needs. He also has been working to lower a dependency on mobile-phone chips by selling semiconductors to automakers and other manufacturers.

“Now we have more growth vectors than just mobile,” Amon said in an interview. “Clearly Qualcomm is no longer defined by a single market.”

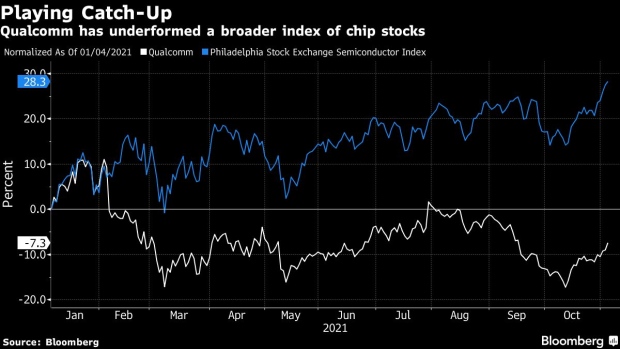

Qualcomm shares climbed as much as 5.1% to $145.54 in extended trading. They had been down 9.1% this year through Wednesday’s close, trailing a 28% gain by the Philadelphia Stock Exchange Semiconductor Index.

New 5G networks -- a speedier wireless standard -- are helping fuel sales of phone chips. Qualcomm earnings also are getting a boost from the so-called internet of things, the push to bring online connections and electronics to a wide range of appliances. Like many other chipmakers, Qualcomm outsources production to companies such as Taiwan Semiconductor Manufacturing Co. and Samsung Electronics Co. A surge in demand has left these foundries unable to keep up with demand, but there have been recent signs that chip shortages may be easing.

Qualcomm’s Amon has said that his company’s access to supply would improve as the year went on, allowing it to meet more demand. The upbeat outlook suggests those efforts are working.

“We’ve done what we said we’d do,” he said Wednesday.

Excluding certain items, profit was $2.55 a share in the fiscal fourth quarter, compared with Wall Street’s average estimate of $1.95. Adjusted revenue grew 43% to $9.32 billion, topping the $8.86 billion projection.

The company is unique in the industry because a large chunk of its profit comes from technology licensing. Makers of phones pay to use Qualcomm’s technology regardless of whether they buy its chips, because it owns patents that cover some of the fundamentals of mobile communications. After a multiyear legal battle with Apple Inc., the two companies settled and Qualcomm has become a supplier of modems -- the chips that connect phones to the cellular networks -- to the iPhone. Some investors are concerned that that boost in revenue will be relatively short lived because Apple will eventually build its own component.

©2021 Bloomberg L.P.