Apr 8, 2020

Quick Rebound in Wuhan Car Sales Give Hope to Battered Industry

, Bloomberg News

(Bloomberg) --

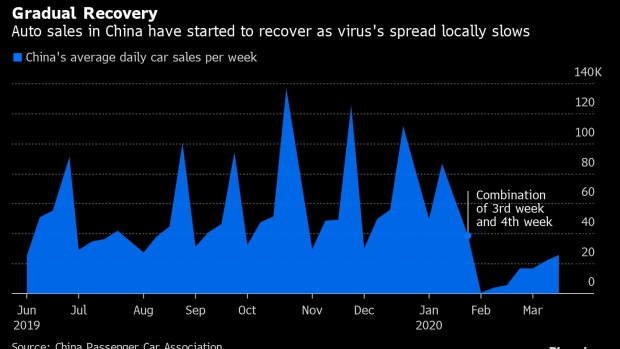

A recovery in China’s car market is slowly gathering pace, with dealerships even in the initial virus epicenter of Wuhan seeing customers return.

Vehicle sales have been picking up since early February -- albeit from a near-zero level -- as showrooms gradually re-open their doors. In Wuhan, a city of 11 million, dealerships have been back in business for only a couple of weeks yet staff at some of them say daily sales have rebounded to pre-crisis levels.

“I was pretty shocked,”” said Zhang Jiaqi, a sales representative at an Audi AG dealer in the Wuchang district of Wuhan, which is now recording daily sales matching year-earlier levels. “It’s like a boom after a two-month dormancy. I thought sales would be frozen.”

The revival offers a sliver of hope for global carmakers from Audi parent Volkswagen AG to General Motors Co. and Toyota Motor Corp., whose sales are slumping in other regions of the world as the virus spreads. A recovery in China would suggest that consumers are willing to again spend on big-ticket items soon after emerging from isolation and lockdowns.

Safer Option

Some consumers in Wuhan are now even more willing to buy a car than before the virus crisis, as they see personal vehicles as safer than public transport, said Pan Fei, a marketing director at the Wuchang Audi shop. Demand at the store is now skewed toward smaller vehicles such as the A3, suggesting some families are buying second vehicles.

In a nearby Cadillac dealership, sales representative Xia Tianyi said foot traffic and sales have returned to pre-shutdown levels. The store has seen a pickup in first-time buyers, with health-care professionals such as doctors now among those purchasing personal vehicles, Xia said.

Weekly retail car sales, which plummeted as much as 96% in China amid the crisis, have steadily improved for more than a month. During the first three weeks of March, sales fell 50%, 44% and 40%, respectively, according to China Passenger Car Association, which on Wednesday said preliminary data showed nationwide sales in March slipped 36% from a year ago. The group also forecast that weekly sales will rebound to last year’s levels by the end of this month.

About 99% of China’s showrooms had resumed operation as of April 3, with consumer traffic at the outlets rebounding to about 66% of normal levels, according to China Automobile Dealers Association.

Risks Remain

To be sure, a sustainable rebound in China is far from certain and the latest numbers simply reflect the depth of the recent slump. The biggest market in the world was paralyzed by the outbreak, with factories and dealerships shuttered and people ordered to stay home.

Now such restrictions have been loosened, and the government has also introduced stimulus measures to spur vehicle sales. Such move may have a short-term positive effect, but it’s unclear whether they help increase the underlying long-term demand.

Yet some manufacturers are cautiously positive. BMW AG said on April 6 it saw a reversal in demand trends in March “pointing to a sustainable recovery” in China.

“We are reacting to the globally challenging sales situation caused by the corona pandemic and are flexibly adapting our production volume to demand,” BMW sales head Pieter Nota said in a statement. “In China, we are seeing the first signs of recovery with a strong order intake.”

©2020 Bloomberg L.P.