German Real Estate Firm Adler Reaches Agreement With Lenders

Troubled German real estate firm Adler Group SA has reached a non-binding agreement with bondholders, according to a company statement released on Thursday morning.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Troubled German real estate firm Adler Group SA has reached a non-binding agreement with bondholders, according to a company statement released on Thursday morning.

The deep freeze that’s gripped Europe’s real estate markets since borrowing costs jumped worsened at the start of the year as deals plunged to their lowest levels since 2011.

Investors are looking for the next policy domino to fall in Asia amid an escalating campaign against a resurgent dollar, after Indonesia used a surprise interest rate hike to defend the rupiah.

Vietnamese billionaire Pham Nhat Vuong pledged to invest at least another $1 billion of his personal wealth into VinFast Auto Ltd., providing the capital needed for expansion of the struggling electric vehicle maker.

Macrotech Developers Ltd., a real estate firm that operates under the brand name Lodha, expects pre-sales to grow about 20% in the year to March after reporting its highest ever quarterly revenue.

Mar 2, 2020

, Bloomberg News

Canadian consumer sentiment fell last month after nationwide protests disrupted rail traffic across the country and fueled worries about the nation’s economy, even before financial markets were rattled by the spreading coronavirus.

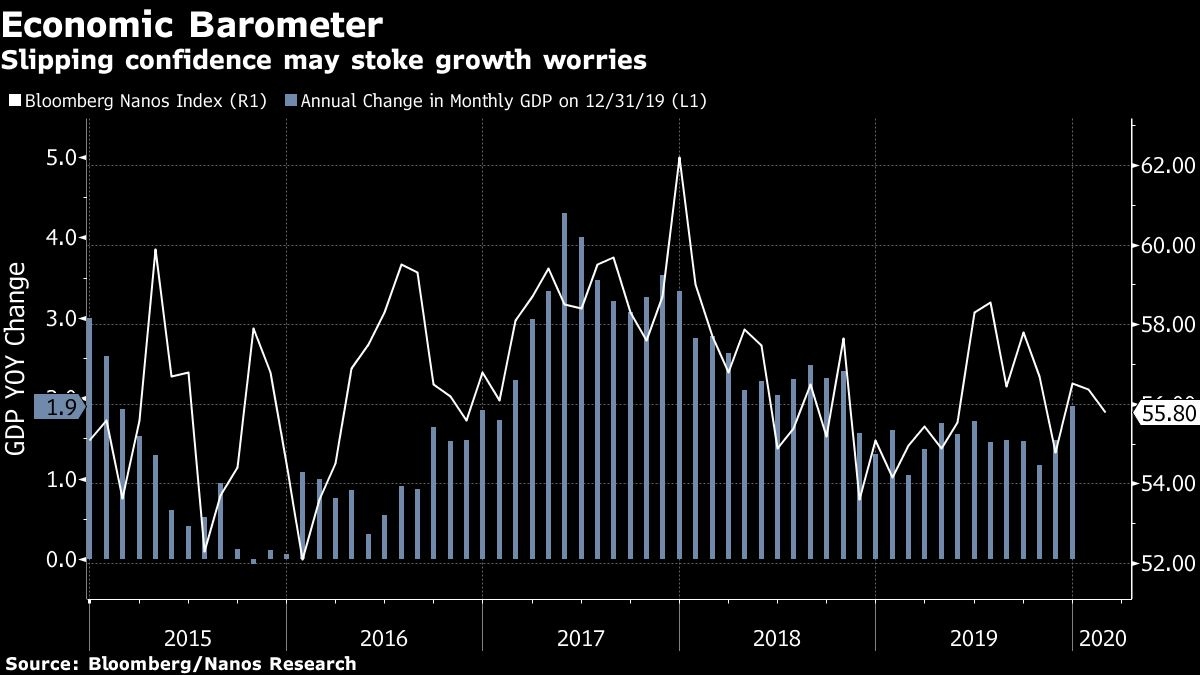

The Bloomberg Nanos Canadian Confidence Index, a composite gauge based on weekly telephone polling, dropped in February to below historical averages on growing unease about the economic outlook. The drop wasn’t dramatic, and sentiment remains above lows over the past year -- but the move reverses some of the gains recorded over the past couple of months. More concerning, the survey data have yet to fully capture the impact of last week’s dive in financial markets amid concerns the coronavirus will undermine the global economic expansion.

Weakening confidence would be a bad sign for a Canadian economy that is running out of drivers of growth and has increasingly relied on household spending to produce even the modest gains the nation has recorded over the past six months. Sluggish confidence could prompt consumers to curtail purchases going forward -- a concern the Bank of Canada has been highlighting in recent weeks and one of the reasons why the central bank is expected to cut interest rates as soon as this week.

Every week, Nanos Research calls 250 Canadians for their views on personal finances, job security and their outlook for both the economy and real estate prices. Bloomberg publishes four-week rolling averages of the 1,000 telephone responses.

The aggregate index number fell to 55.8 in February, down from 56.4 at the end of January. The decline occurred in the final two weeks of the month. The composite index has averaged 56.5 over the past year, and 57 since 2013.

The decline in sentiment in February was largely confined to western Canada, with confidence in Quebec and Ontario little changed -- suggesting the rail disruptions were responsible for the weaker numbers. Demonstrations in several provinces by environmental and indigenous-rights activists had crippled freight and passenger traffic across Canada for more than two weeks last month.

The numbers show Canadians becoming less confident about the economic outlook. The share of Canadians who say the economy is expected to strengthen over the next six months has fallen to 13.5 per cent, down from 15.6 per cent at the end of January. That reading has averaged 15.1 per cent over the past year and almost 20 per cent historically. The percentage of respondents who expect a weakening outlook rose to 35.9 per cent, the highest since April 2019.

The questions on personal finances and job security were little changed over the past month. Real estate sentiment actually gained in February, acting as an offset to worries about economic growth. The share of Canadians who see home prices rising increased to 48.4 per cent, which is one of the highest readings on record in weekly data going back to 2013.

--With assistance from Erik Hertzberg.