Feb 22, 2019

Rally in Indian Stocks Tested as Sensex Swings Between Losses and Gains

, Bloomberg News

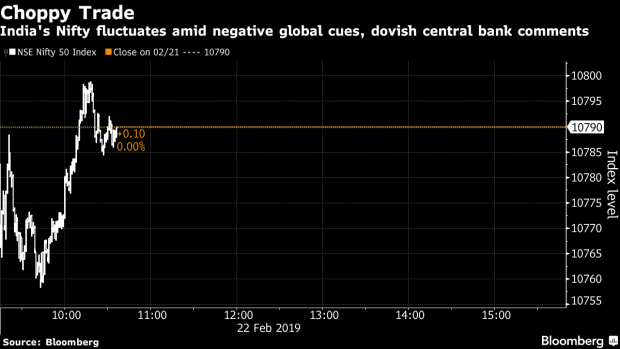

(Bloomberg) -- Indian equities fluctuated as investors continued to look ahead to the outcome of a national election for direction even as minutes of the recent central bank meeting signaled more cuts in the key interest rate. Most Asian indexes fell Friday, as did U.S. stocks overnight, amid concerns over growth in the global economy.

The S&P BSE Sensex climbed 0.1 percent to 35,925.88 as of 10:16 a.m. in Mumbai, swinging at least four times between gains and losses. The NSE Nifty 50 Index also rose 0.1 percent as both the gauges head for their third week of gains in four. Gauges of mid- and small-sized companies gained.

Even as minutes of the latest central bank meeting signaled more cuts in the key interest rate, uncertainty about the composition of the next national government is weighing on sentiment. Prime Minister Narendra Modi’s re-election bid has turned out tougher than earlier expected, with at least three pre-poll surveys suggesting that he won’t win a majority.

Read: Modi May Struggle to Win Majority in Polls, Fitch Solutions Says

Strategist Views

- “Markets will get a conclusive direction only after the election results in May, and they will keep reacting to global cues until then due to the lack of any significant local factors,” said Chokkalingam G., managing director at Equinomics Research & Advisory Pvt.

- “I see the Nifty trading in a 5 percent range from these levels until the election outcome and don’t expect only a minor correction if the results aren’t to investors’ liking,” he said.

- This is a good opportunity to buy mid- and small-sized stocks after their recent decline as they’re expected to rally more if a stable government comes to power,” Chokkalingam said.

The Numbers

- Thirty-four of the 50 Nifty shares and 20 of the 31 Sensex stocks gained. Yes Bank Ltd. advanced the most among Sensex members, rising 2.1 percent, extending its gain this year to 21 percent.

- Fifteen of the 19 sector indexes compiled by BSE Ltd. advanced, led by a gauge of automakers.

- The S&P BSE MidCap and the S&P BSE SmallCap indexes extended their rallies to a fourth day.

- Kotak Mahindra Bank Ltd. dropped the most among Sensex and Nifty members, falling 3.7 percent, as ING was said to have sold 23 million shares, according to terms of the deal.

Analyst Notes/Market-related Stories

- Rupee Bonds May Gain After Dovish RBI Minutes: Inside India

- Mahanagar Gas Rated New Neutral at Macquarie; PT 800 Rupees

To contact the reporter on this story: Ameya Karve in Mumbai at akarve@bloomberg.net

To contact the editors responsible for this story: Divya Balji at dbalji1@bloomberg.net, Kurt Schussler

©2019 Bloomberg L.P.