Sep 23, 2021

Rates Traders Bring Forward Pricing of Fed Liftoff to End-2022

, Bloomberg News

(Bloomberg) -- Traders in interest-rate futures have brought forward their expectations for the first hike by the Federal Reserve to December 2022, after policy makers showed a growing inclination this week to start removing stimulus measures. The implied yield of the December 2022 fed fund futures contract has jumped about 5 basis points over the past two days to 0.28%, suggesting a 25-basis-point rate increase by then was fully priced. Investors had previously expected the Fed to start liftoff in early 2023. Overnight index swaps are giving almost even odds of a hike by the September 2022 meeting.

Traders boosted their rate wagers in the wake of Wednesday’s Fed meeting, which was viewed as hawkish after Chair Jerome Powell said the central bank could begin scaling back asset purchases in November and complete the process by mid-2022. New quarterly projections in the so-called dot plot also favored that view, with nine of 18 officials now seeing a rate hike next year, up from seven in June. The median dots suggest the federal funds rate may rise to 1% in 2023, and to 1.75% in 2024.

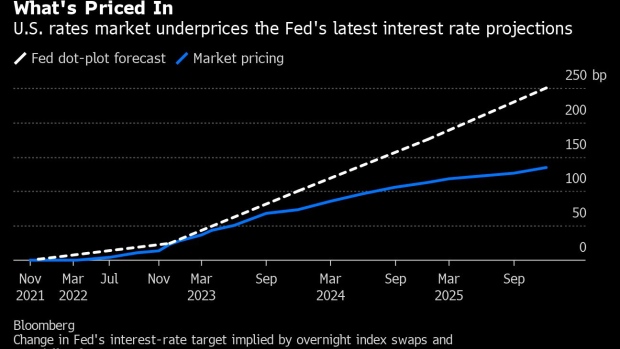

While the market has boosted near-term projections for rate hikes, further out wagers are well short of those indicated by the Fed. Rate traders are pricing in less than five hikes through 2024, compared with seven increases implied by the Fed’s dot plot.

©2021 Bloomberg L.P.